On-chain knowledge suggests a Bitcoin indicator is at the moment mirroring the identical development that led to the highest of the bull run in 2021.

Bitcoin Lengthy-Time period Holder Distribution Seems To Be Ending

As defined by CryptoQuant neighborhood supervisor Maartunn in a submit on X, the BTC long-term holders are at the moment showcasing a development that’s harking back to 2021.

The “long-term holders” (LTHs) are Bitcoin traders who’ve been conserving their cash dormant (that’s, not transferring or promoting them from their pockets) for greater than 155 days.

Typically, the longer a holder retains their cash nonetheless, the much less seemingly they’re to maneuver them at any level. As such, the LTHs, with their lengthy holding instances, are thought-about the market’s resolute palms.

These traders normally don’t react to occasions within the wider market, like a rally or crash, however this 12 months’s worth surge in direction of the brand new all-time excessive (ATH) has compelled even these HODLers into promoting.

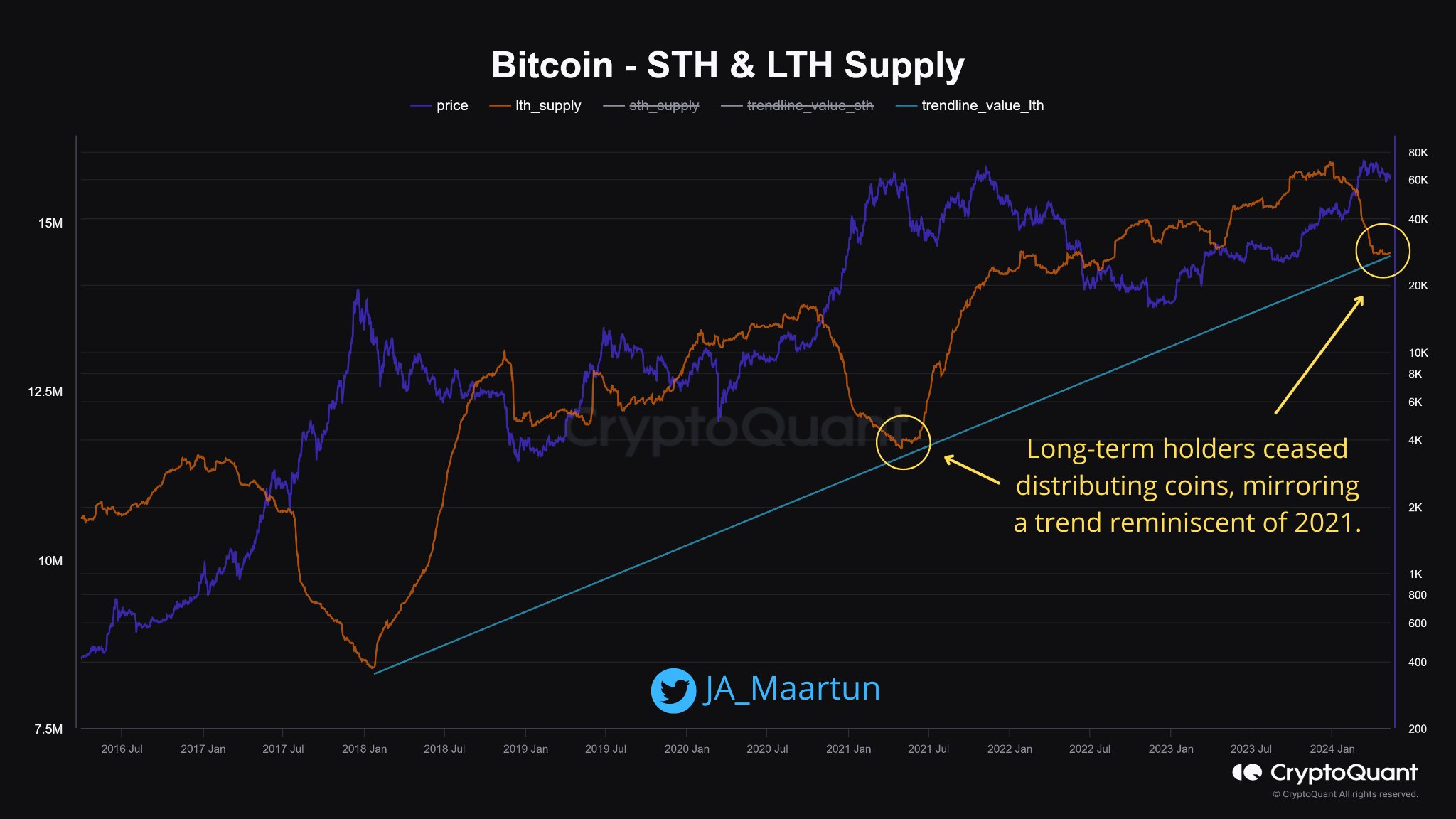

The chart beneath exhibits the development within the whole Bitcoin provide held by the addresses belonging to the LTH cohort over the previous couple of years:

Because the graph exhibits, Bitcoin LTHs have been accumulating between the Might 2021 crash and this 12 months’s rally. With this rise in direction of the brand new ATH, although, the provision of those HOLDers has began observing a downtrend as an alternative.

One thing to remember is that the indicator has a 155-day delay relating to shopping for, as solely mature provides can depend below it.

Thus, when the metric goes up, it doesn’t imply that there’s accumulation within the current however reasonably that some shopping for occurred 155 days in the past, and these cash have simply now aged sufficient to depend below the LTHs.

For promoting, although, no such delay is hooked up, as cash exit the group as quickly as they’re transferred on the community. As such, the most recent decline would correspond to a selloff that has been occurring within the current.

Lately, because the Bitcoin worth has fallen prey to stagnation, the LTHs have slowed down their promoting, with the provision roughly shifting sideways. As Maartunn has highlighted within the chart, this development is just like what was noticed in 2021.

The LTHs ending their distribution then meant a high for the cryptocurrency. An analogous sample was additionally witnessed through the 2017 bull run. Due to this fact, going by these historic precedents, the most recent flat motion within the LTH provide might additionally counsel a possible peak for the most recent bull run.

That is provided that, in fact, the LTH distribution has actually ended. The chart exhibits that in every of the final two bull markets, the preliminary sharp promoting from the LTHs was adopted up by a section of slower-paced distribution.

This slowed-down decline continued for months earlier than the metric reached the consolidation section and the asset’s high occurred. It now stays to be seen if the most recent development shift within the Bitcoin LTH provide corresponds to the previous or the latter section.

BTC Worth

On the time of writing, Bitcoin is floating across the $62,700 degree, down virtually 2% over the previous week.