Table of Contents

Editor’s observe: It is a recurring put up, often up to date with new info and provides.

At TPG, we commit a major period of time to speaking about how credit score scores work, methods to enhance yours and how one can preserve it in form. Though an honest credit score rating will probably be sufficient to get you permitted for a lot of journey bank cards, a number of the most rewarding premium playing cards require top-notch credit score.

There isn’t a magic quantity that ensures approval for a particular card, however we are able to analyze public information factors to gauge your odds.

Let’s speak about among the finest premium bank cards at the moment in the marketplace: the Chase Sapphire Reserve® — and what the unpublished credit score rating requirement appears to be like wish to get permitted if you apply.

Overview of the Chase Sapphire Reserve

The Chase Sapphire Reserve has persistently been among the finest journey rewards bank cards since its launch in 2016. It provides a decent 3 factors per greenback spent on all journey and eating, and it comes with a number of the most intensive journey protections out there on any bank card.

It has a $550 annual charge, however advantages like an annual $300 journey credit score, as much as $5 in month-to-month DoorDash credit (by means of Dec. 2024), Precedence Cross airport lounge entry and a World Entry/TSA PreCheck utility charge credit score assist offset it.

Plus, new cardholders can earn 75,000 Final Rewards factors after spending $4,000 on purchases within the first three months — price $1,538, primarily based on TPG valuations.

Associated: Chase Sapphire Reserve bank card evaluate

What credit score rating do it’s essential to get the Chase Sapphire Reserve card?

The Chase Sapphire Reserve has barely stricter approval necessities than its sibling, the Chase Sapphire Most popular® Card. Experiences counsel that you just’ll usually want a rating of no less than 740 to get permitted for the cardboard, although the common rating is barely greater. Individuals with scores beneath 700 have been permitted for the cardboard, however the approval often isn’t prompt in these circumstances.

In case your rating is on the decrease finish of the vary, understand that many different elements go into qualification, corresponding to your revenue and your credit score accounts’ age. Within the context of Chase, one other massive issue is your relationship with the financial institution.

Should you’ve been a longtime Chase buyer and have different Chase playing cards to show you’ll be able to pay your payments on time or have massive balances in your banking accounts with them however below-average credit score historical past, you might have higher approval odds.

Experiences counsel that these with a banking relationship may additionally have the ability to increase their odds by making use of in a department.

One other concept is to use for the Chase Sapphire Most popular with the decrease rating requirement after which request a product change to the Chase Sapphire Reserve.

Associated: What credit score rating do it’s essential to get the Chase Sapphire Most popular card?

What number of card accounts can I’ve open?

The Chase Sapphire Reserve is topic to Chase’s unpublished 5/24 rule. Which means should you’ve opened 5 or extra private bank cards with any issuer within the final 24 months, Chase will routinely reject your utility for this card, even you probably have an ideal credit score rating.

The 5/24 rule is hardcoded into Chase’s methods and might’t be manually overridden, so should you’re over 5/24, there’s no profit to taking an opportunity on an utility simply to see what occurs.

You additionally received’t be permitted should you at the moment maintain the Chase Sapphire Most popular; plus, it’s essential to wait no less than 48 months between incomes the sign-up bonus on one card earlier than you’ll be able to earn it on the opposite.

Associated: The way to calculate your 5/24 standing

The way to test your credit score rating

It will be greatest should you by no means shelled out money to test your credit score rating. Most bank cards include a free FICO rating calculator which makes it simple to see the place your rating lies on the dimensions from good to dangerous and preserve updated on the way you’re doing.

You too can simply open accounts on websites like Credit score Karma or Credit score Sesame. These websites are free and might help you retain even higher observe of your rating and its elements. You too can use these providers to dispute any info in your rating that isn’t correct or seems to be fraudulent.

Websites like Credit score Karma additionally present common, automated updates when your rating modifications, in addition to alerts any time a brand new inquiry is added to your credit score report. Since these websites carry out comfortable pulls, they received’t negatively impression your credit score rating.

Components that have an effect on your credit score rating

Earlier than you begin making use of for any bank cards, it’s necessary to know the elements that make up your credit score rating, as making use of for brand spanking new traces of credit score will change your rating.

Associated: 5 lesser-known issues that have an effect on your credit score rating

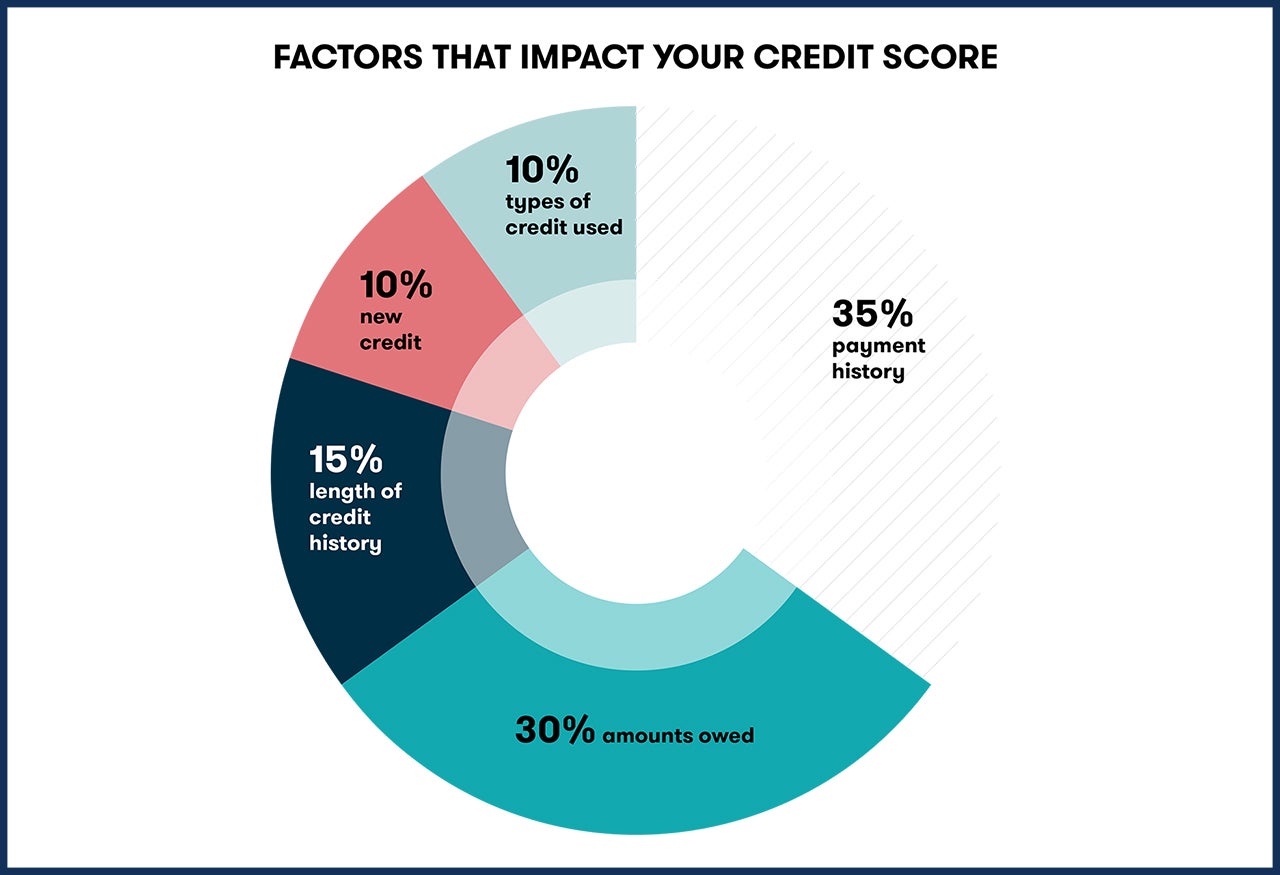

Whereas the precise method for calculating your credit score rating is stored secret, FICO could be very clear concerning the various factors they assess and the way a lot weight every is given:

- Fee historical past. 35% of a FICO rating is made up of your cost historical past. Should you get behind in making mortgage funds, it may end up in a drop. The longer and more moderen the delinquency, the better the destructive impression in your credit score rating.

- Quantities owed (utilization). 30% of your FICO rating consists of the relative measurement of your present debt. Specifically, your debt-to-credit ratio is the whole of your money owed divided by the whole quantity of credit score you’ve been prolonged throughout all accounts. Many declare it’s greatest to have a debt-to-credit ratio beneath 20%, nevertheless it’s not a magic quantity.

- Size of credit score historical past. 15% of your rating is predicated on the common size of all accounts in your credit score historical past. This turns into a major issue for these with minimal credit score histories, corresponding to younger adults, latest immigrants and anybody who has largely averted credit score. It can be an element for individuals who open and shut accounts inside a concise interval.

- New credit score. Your most up-to-date accounts decide 10% of your credit score rating. Having not too long ago opened too many accounts will damage your rating, because the scoring fashions will interpret this as an indication of doable monetary misery.

- Credit score combine. 10% of your rating is said to what number of completely different credit score accounts you have got, corresponding to mortgages, automotive loans, credit score loans and retailer cost playing cards. Whereas having a bigger mixture of loans is healthier than having fewer, nobody recommends taking out pointless loans to spice up your credit score rating.

Associated: Methods to enhance your credit score rating

A big issue for the Chase Sapphire playing cards is your common age of accounts. Whereas a lengthier credit score historical past will increase your rating, many issuers concentrate on the one-year cutoff. That signifies that having a median age of accounts of greater than a 12 months can enhance your odds of approval. In distinction, you might need bother getting permitted with 11 months of credit score historical past, even when your numerical credit score rating is nice.

Additionally, you probably have any delinquencies or bankruptcies in your credit score report, Chase may be hesitant to approve you for a brand new line of credit score even when your rating is in any other case strong.

It’s necessary to do not forget that your credit score profile is greater than only a quantity. It’s a set of data given to the issuer to investigate your creditworthiness.

What to do should you get rejected

Don’t hand over in case your utility for the cardboard initially will get denied. Should you obtain a rejection letter, it is best to first take a look at the explanations given in your rejection. By legislation, card issuers are required to ship you a written or digital communication explaining what elements prevented you from being permitted.

Associated: The final word information to bank card utility restrictions

When you’ve discovered why you’ve been rejected, name Chase’s reconsideration line. Inform the particular person on the telephone that you just not too long ago utilized for a Chase bank card “and also you have been shocked to see that your utility was rejected, and also you want to converse to somebody about reconsidering that call.”

From there, it’s as much as you to construct a case and persuade the Chase agent on the telephone why you deserve the bank card.

Should you have been rejected for too in need of a credit score historical past, you could possibly level to your stellar document of on-time funds. Should you have been rejected for missed funds, you could possibly clarify that these have been a very long time in the past, and your document since then has been good. Should you do your banking with Chase, point out that too.

Whereas there’s no assure that this technique will work, there are a lot of reviews of rejections being reversed on reconsideration, so it’s price spending quarter-hour on the telephone if it’d show you how to get the cardboard you need.

The opposite doable choice is in your utility to enter “pending” standing. This implies that you could be (finally) be permitted, however Chase wants extra time to evaluate your utility or new info to decide. Should you obtain this discover, it is best to positively name the reconsideration line. You might simply must confirm a element in your utility, or you probably have different Chase playing cards, you might must shift credit score traces round.

Backside line

It needs to be no shock that, as one of the crucial premium playing cards on the market, the Chase Sapphire Reserve requires a superb credit score rating to be permitted.

That stated, there are methods you could possibly enhance your odds, corresponding to establishing a banking relationship with Chase. Alternatively, you could possibly apply for the Chase Sapphire Most popular first, get its 75,000-point welcome bonus after spending $4,000 in purchases inside the first three months after which request a product change.

Additional studying:

- What credit score rating do it’s essential to get the Chase Sapphire Most popular card?

- What credit score rating do it’s essential to get the Capital One Enterprise Rewards card?

- What credit score rating do it’s essential to get the Southwest Premier Credit score Card?

- What is an efficient credit score rating?

New to the factors and miles recreation? Try our newbie’s information for all the pieces it’s essential to know to get began!

Apply right here: Chase Sapphire Reserve and earn 75,000 Final Rewards factors after spending $4,000 on purchases within the first three months.

Apply right here: Chase Sapphire Most popular and earn 75,000 Final Rewards factors after spending $4,000 on purchases within the first three months.