In a publish shared on X on January 26, crypto analyst BitQuant forecasts that Bitcoin (BTC) will recuperate from the present downtrend and surge previous its all-time excessive of $69,000 to over $250,000 earlier than the upcoming Bitcoin halving in April.

Bitcoin To $250,000 Earlier than Halving?

From the chart shared, BitQuant notes that Bitcoin continues to be trending inside a rising channel. Out of the multi-year uptrend that the coin is in, this channel’s subsequent “contact” is projected to be at round $250,000.

For now, if the development line guides, Bitcoin has instant resistance at about $80,000. This stage needs to be the following key goal for bulls to retest. In response to BitQuant, it’s possible that Bitcoin will float above this line to $250,000 by April earlier than the community routinely halves block mining rewards.

Extrapolating from the analyst’s preview, the Bitcoin uptrend stays legitimate till the higher restrict outlined by the rising development line is “touched.” Even so, when this stage can be breached will not be specified.

As soon as this line is examined, inserting the coin at over $250,000, it should possible comply with its historic sample by cooling off. The depth of this retracement will not be additionally outlined however is anticipated to be deep since BitQuant mentioned the coin will “die.”

BitQuant defined that this “dying” interval refers to Bitcoin’s value going under its earlier all-time excessive. The retracement can be anticipated. That is frequent after halving since provide tends to extend as demand for the coin softens. Regardless of this momentary setback, BitQuant stays assured that BTC will regain momentum and proceed its long-term upward development.

Spot Bitcoin ETF Issuers Shopping for, BTC Stabilizes Above $39,500

Although the analyst stays bullish, it’s unclear how costs will pan out for now. The US Securities and Trade Fee (SEC) lately permitted a number of spots for Bitcoin exchange-traded funds (ETFs).

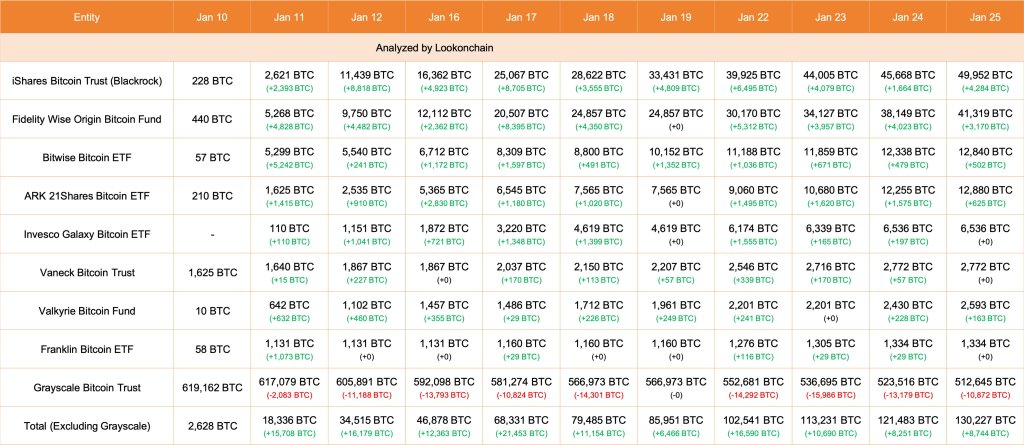

Although issuers have been ramping up purchases, Grayscale Investments have liquidated their Grayscale Bitcoin Belief (GBTC), promoting shares and dumping cash through exchanges.

Current knowledge from Lookonchain reveals that GBTC decreased 10,872 BTC price over $447 million on January 25. In the meantime, eight spot Bitcoin ETF issuers added 8,744 BTC, with BlackRock including 4,284 BTC. On January 24, GBTC decreased 13,179 BTC with Constancy Investments, one other spot Bitcoin ETF issuer, shopping for 4,023 BTC.

With BTC discovering demand, costs have began stabilizing, trying on the growth within the each day chart. The coin is regular above $39,500, rejecting the extraordinary promoting strain of January 22.