On-chain knowledge reveals that Bitcoin buyers have ended their web profit-taking spree lately, a possible signal {that a} value reversal might happen quickly.

Bitcoin Each day Realized Revenue Loss Ratio Has Dipped Beneath 1 Lately

As defined by CryptoQuant writer Axel Adler Jr in a brand new submit on X, realized losses have began to exceed earnings lately. The on-chain metric of curiosity right here is the “Each day Realized Revenue Loss Ratio,” which, as its identify suggests, tells us about how the Bitcoin buyers’ earnings examine towards the losses.

The metric works by going by the transaction historical past of every coin bought to see what value it was moved at earlier than this. If this earlier promoting value for any coin was lower than the present spot value, then that specific coin is being moved at a revenue.

Equally, gross sales of cash of the alternative kind result in loss realization. The indicator provides these earnings and losses for your complete market and takes their ratio to provide its worth.

When the indicator is above 1, the buyers notice extra earnings than losses with their promoting. Alternatively, this threshold implies the dominance of loss-taking available in the market.

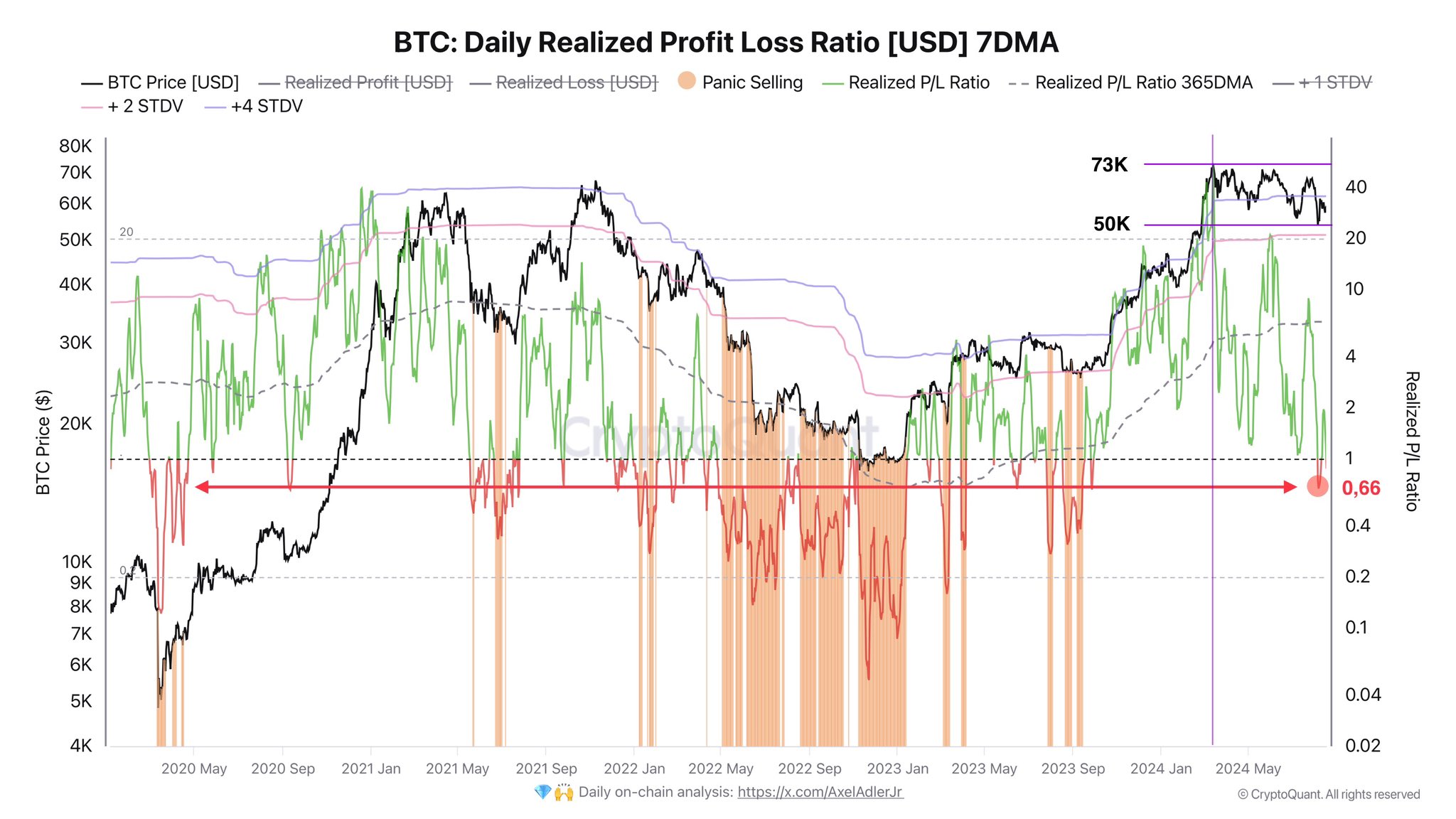

Now, here’s a chart that reveals the pattern within the Bitcoin Each day Realized Revenue Loss Ratio over the previous few years:

As displayed within the above graph, the Bitcoin Each day Realized Revenue Loss Ratio has largely been above 1 for the previous 12 months. Not simply that, the indicator has been considerably above the mark for lots of this time, which suggests revenue realization has been fairly notable.

The rationale behind that is the appreciation the BTC value has loved throughout this era. From the chart, it’s seen that peak profit-taking coincided with the all-time excessive (ATH) in March, as could be anticipated.

Curiously, profit-taking nonetheless massively outweighed the loss-taking within the months that adopted the ATH, the place BTC value consolidated inside a variety. It could seem that this urge for food for taking earnings has run out lately, a possible results of the sideways trajectory displaying no indicators of ending.

The ratio has now began to flip the opposite means, with losses taking heart stage. The analyst has famous that such a shift in the direction of loss-taking typically happens on the finish of consolidation intervals.

To this point, the bottom the ratio has gone is 0.66, which isn’t too low in comparison with previous loss-taking occasions. Thus, the capitulation might deepen earlier than Bitcoin can begin a contemporary rally.

BTC Worth

Bitcoin has lately continued to be locked in a sideways trajectory as its value nonetheless trades round $58,400.