Table of Contents

Editor’s observe: This can be a recurring publish, usually up to date with new info and presents.

When you’re taking stock of the safety measures in all areas of your life, don’t pass over your credit score.

With a latest alleged hack, probably each American might have had their Social Safety quantity and bodily deal with stolen. It’s alleged that 2.9 billion information have been stolen from Nationwide Public Knowledge, a public information firm, in April 2024.

Now, it’s extra crucial than ever to make sure your credit score file is safe and also you aren’t susceptible to your private info entering into the improper arms. We suggest you examine your credit score file instantly and see if there are any irregularities to take the required precautions. Moreover, you must replace passwords to any e mail accounts, financial institution accounts or providers the place your knowledge could possibly be compromised.

Whereas it’s almost unattainable to totally protect your self from bank card fraud or identification theft, there are some steps you’ll be able to take, resembling freezing your credit score. However, after all, credit score freezes include some degree of inconvenience, like all safety measures.

We’re explaining how and why you might wish to freeze your credit score.

What’s a credit score freeze?

A credit score freeze prevents you or others from opening an account in your title. It really works by stopping collectors from accessing your credit score file so collectors and lenders can not give you (or anybody pretending to be you) any type of credit score.

A freeze is free, easy to request and has no impression in your credit score rating.

The catch is that earlier than you’ll be able to apply for a brand new bank card or mortgage, it’s important to elevate your credit score freeze first. Fortuitously, that’s additionally free to do, however it’s inconvenient should you open new traces of credit score usually.

Associated: The way to examine your credit score rating free of charge

How do I freeze my credit score?

To freeze your credit score, you should request freezes in any respect three credit score bureaus. You are able to do this on-line or over the telephone.

The bureaus are required to freeze your credit score experiences inside one enterprise day. When you’ve requested a freeze, every company provides you with a singular PIN or password. It’s very important that you just maintain the PIN or password in a secure area, because it’ll be wanted if you wish to unfreeze your report (defined in a while.)

Earlier than you go surfing or name, be prepared to offer private info resembling your title, deal with, date of start and Social Safety quantity.

Freezing your credit score on-line

You’ll be able to full the method on-line by visiting every credit score bureau’s web site:

Freezing your credit score by telephone

You may also contact the businesses by telephone to request a freeze on the following numbers:

- Equifax: 888-298-0045

- Experian: 888-397-3742

- TransUnion: 888-909-8872

Observe that even after you’ve frozen your credit score, you’ll proceed to obtain prescreened bank card presents until you opt-out by calling 888-567-8688.

Associated: The way to defend your self towards rewards program knowledge breaches

Who can entry frozen credit score experiences?

A credit score freeze prevents new collectors from accessing your credit score report. Nevertheless, your credit score will stay obtainable to some entities, resembling present collectors or debt collectors performing on their behalf. Moreover, authorities businesses could have entry in response to a court docket or administrative order, a subpoena or a search warrant.

When ought to I freeze my credit score?

You must provoke a credit score freeze should you consider your private info has been compromised. Listed here are only a few situations that will warrant a credit score freeze:

- Your pockets has been stolen and comprises private identification info like a driver’s license, a passport, a Social Safety card and bank cards

- You fall sufferer to a rip-off

- Your info was compromised throughout a knowledge breach

- You discover an unfamiliar credit score inquiry in your credit score report

In any of those instances, you also needs to file an identification theft report with the federal government, providing you with sure rights to wash up any broken credit score that wasn’t your doing.

Associated: The way to determine and forestall bank card fraud

Does a credit score freeze have an effect on my credit score rating?

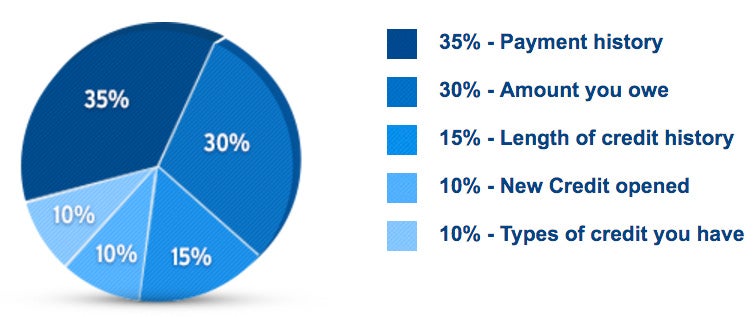

In brief, no. Your credit score rating is used to find out your creditworthiness and relies in your credit score historical past from the three main client credit score bureaus. A credit score freeze doesn’t have an effect on your credit score rating positively or negatively.

Associated: How your credit score scores work

Professionals and cons of a credit score freeze

A credit score freeze is the best approach to stop fraudulent accounts from being opened in your title — and contemplating it’s free to do, there’s no motive to not should you assume your info has been compromised.

Nevertheless, a credit score freeze additionally prevents you from with the ability to open a brand new account whereas it’s in place. To open a brand new account, you’ll need to individually contact every company to unfreeze your credit score, which could be tedious. Plus, a credit score freeze is not going to stop or provide you with a warning of fraud on any present accounts.

Associated: What’s the distinction between a credit score freeze and a fraud alert?

How do I unfreeze my credit score?

In just a few states, your credit score freeze will mechanically expire after seven years. Usually, nevertheless, your freeze will stay in place till you ask the credit score reporting company to take away it.

To unfreeze your experiences — for instance, to use for a mortgage mortgage or new bank card — you should contact every of the three businesses individually. When you request this, the bureaus should elevate your freeze inside one hour. Listed here are the hyperlinks and telephone numbers:

- Equifax: 888-298-0045

- Experian: 888-397-3742

- TransUnion: 888-909-8872

You will want your distinctive PIN or password that was given throughout the preliminary credit score freeze. Whenever you quickly unfreeze your report, you should definitely give the businesses a particular interval or ask to elevate it only for a particular celebration.

Say, for instance, you wish to open a brand new bank card. If doable, contact the issuer to ask which company (or businesses) it pulls your credit score info from. Then, ideally, you’ll be capable of contact that credit score company (or businesses) and unfreeze your report for both a interval or just for the issuer who will probably be inquiring about your credit score file.

Backside line

Freezing your credit score generally is a useful gizmo in serving to stop you from falling sufferer to identification theft. It may be inconvenient, however many discover it definitely worth the peace of thoughts, particularly with the latest alleged knowledge hack.

Additional studying:

- So that you fell prey to a rip-off: 5 steps to take when your private info is compromised

- 8 greatest components that impression your credit score rating

- 6 issues to do to enhance your credit score rating

- Clearing up confusion: Why your credit score rating could also be totally different relying on the place you look