Table of Contents

Once they descended into coal mines, miners would take a caged canary with them. The poisonous gasses, notably carbon monoxide, that accumulate in these locations and pose a lethal danger to miners, would kill the canaries earlier than the miners. This info made them conscious of the hazard, enabling them to evacuate earlier than it was too late.

On Might 14, 2024, Alexey Pertsev, a software program developer who constructed an open-source software to protect on-line privateness, was discovered responsible of cash laundering and sentenced to greater than 5 years in jail by a Dutch courtroom.

Within the courtroom’s choice, the next could be learn: “The software developed by the suspect and his co-authors combines most anonymity and optimum concealment methods with a severe lack of identification functionalities. Subsequently, the software can’t be characterised as a professional software that has been inadvertently utilized by criminals. By its nature and operation, the software is particularly meant for criminals.”

Looking for to protect one’s privateness is thus at worst proof of criminality, at greatest complicity in against the law. A threshold has been crossed.

Sadly, it’s probably that this case will generate little empathy and curiosity, because the individual concerned labored within the crypto business, and the software developed, Twister Money, was meant to protect transaction confidentiality.

Nevertheless, it could be a grave mistake to contemplate this an remoted incident restricted to a fledgling business for which the general public has little affection.

That is our canary within the coal mine.

It has stopped singing and is dying. If we don’t react, all of the miners will perish. Cryptos are an early and obvious revealer of an insidious phenomenon that has been eroding our liberal democracies for about thirty years and is reaching a degree of no return.

Regardless of the shortage of proof of their effectiveness, monetary surveillance measures proceed to be usually strengthened, defying all democratic guidelines and necessities: the primacy of secrecy, freedom as a norm, the precept of proportionality of rights limitations, technological neutrality, presumption of innocence… Preemptive management previous to any offense turns into the norm, the enforcement of regulation turns into selective and arbitrary, checking account closures tackle the looks of censorship and monetary suffocation, and property rights are lowered to a mere shadow.

The battle towards cash laundering and terrorist financing has degenerated into collective hysteria worthy of authoritarian and even totalitarian regimes, to the purpose of criminalizing a basic and constitutional proper: privateness. The well-known American laptop engineer Phil Zimmermann warned us in 1991: “if privateness is outlawed, solely outlaws could have privateness.”

Removed from being a “crypto” concern, this shift away from liberal democracy issues everybody. There are quite a few examples in regimes identified for his or her democracy, spanning from India to the UK, and from Canada to France.

Notice: If the crypto half doesn’t curiosity you, you possibly can proceed on to half II.

I. Classes from the Canary

1. The USA Includes Itself

Lower than a 12 months in the past, the arrest of the Twister Money builders had already legitimately brought on fairly a stir. However the scope of the case, restricted to the crypto world, perceived as a den of terrorists and cash launderers, had shortly confined the indignation to a small group of insiders.

In April 2024, American and European public authorities, emboldened by this success, continued to maneuver ahead in a worrying path.1

A number of occasions occurred nearly concurrently. The arrest of the builders of the Bitcoin pockets builders of Samourai Pockets, by the FBI in cooperation with the IRS (the American tax authority), with the responsible cooperation of European authorities, kicked issues off. Their crime could be to have “conspired to launder cash” and to have “operated an unlicensed cash switch enterprise”.2 They face 20 years’ imprisonment for the primary cost and 5 years for the second. By comparability, the utmost irreducible life sentence in France is 30 years.

Following this was an FBI discover3 urging all People to not use “cash transmitting companies” that don’t acquire their id and aren’t registered. And the Federal Bureau continued by threatening to freeze all funds that had been blended with funds obtained via unlawful means.

To raised perceive the absurdity of such an announcement by the FBI, allow us to transpose the reasoning into the bodily world, and spotlight two main points.

The primary issues the accusation of working an unlicensed cash switch enterprise.

Samourai Pockets is an organization that gives Bitcoin wallets with enhanced transaction privateness. It doesn’t function transactions on behalf of its purchasers; it offers the pockets software program. Within the bodily world, their equal could be a leather-based craftsman who crafts leather-based wallets enabling their customers to retailer money. He facilitates money administration however has no say in how the pockets homeowners spend their money.

Right here, the U.S. federal providers conflate and lump collectively a big financial institution that operates transactions on behalf of its purchasers and a leather-based craftsman, holding the latter answerable for how his purchasers use their money.

How far can we go together with this line of reasoning? To ATMs? To the individuals on the Central Financial institution who print these payments? To the lumberjacks who produce the wooden used for the paper of the payments?

Equally, ought to we maintain a carpenter answerable for what his purchasers determine to place within the furnishings they make? Or an architect if the home they construct finally ends up getting used for drug trafficking?

It shortly turns into obvious that this conflation is totally absurd. A pockets creator will not be answerable for what the pockets proprietor decides to do with the cash saved in it. Being a part of the money or money storage worth chain ought to by no means suggest duty for its remaining use, as there is no such thing as a restrict to this reasoning.

This query was truly raised 20 years in the past concerning peer-to-peer exchanges, which permit a number of individuals to trade info straight in a decentralized method. This communication protocol and the software program that allow it are generally used to commit offenses, notably towards mental property rights. Nevertheless, regardless of makes an attempt to criminalize the software itself4, European5 and American6 courts have dominated in favor of technological neutrality, stating that the software program in query permits each authorized and unlawful exchanges and that their suppliers aren’t answerable for the use made by third events. The case regulation then targeted on the duty of every particular person concerned in a doubtlessly criminality, acquitting some people as a consequence of lack of proof of their prison intent7. These judicial options are clearly according to the traditional train of basic rights.

The second concern lies in the specter of fund blocking.

Freezing any cash blended with funds obtained via unlawful means could be equal to arresting anybody whose payments, whether or not of their leather-based pockets or pocket, have handed via the fallacious arms.

In 2009, a college research lined by CNN confirmed that 90% of American greenback payments carry traces of cocaine, and as much as 100% in some main cities8. This helps us higher perceive the absurdity of the FBI’s menace: nearly all of the money on the earth has already handed via the fallacious arms. Ought to all money holders be imprisoned? After all not.

Following these absurd coercive actions, on 26 April 2024, the US Lawyer for the Southern District of New York revealed the federal government’s rationale towards Roman Storm9, the lead developer of the privateness software program Twister Money. The creator insists, contemplating Twister Money as a “cash transmitting enterprise.”

Based on this argument, “the definition of “cash transmitting” in Part 1960 doesn’t require the cash transmitter to have ‘management’ of the funds being transferred. […] As an illustration, a USB cable transfers information from one machine to a different […].”

A really broad definition of a “cash transmitting enterprise” that will even embrace USB cables, in keeping with their very own admission. At this price, the query will quickly change into “who will not be a cash transmitter?”

Right here, the DOJ (Division of Justice) is so formidable that it goes towards the rules supplied by FinCen (Monetary Crime Enforcement Community, a bureau of the U.S. Treasury Division). In different phrases, the U.S. authorities doesn’t agree with itself, which signifies a sure uneasiness.

In 2013, FinCen defined that software program builders weren’t “cash transmitters” (“The manufacturing and distribution of software program, in and of itself, doesn’t represent acceptance and transmission of worth, even when the aim of the software program is to facilitate the sale of digital forex.”10).

In 2019, following an inquiry concerning sure programmable options on Bitcoin (Time-locked and multi-signature), FinCen reiterated that the partial management that may very well be exercised by pockets builders was not enough to qualify them as “cash transmitters” (“the individual collaborating within the transaction to supply further validation on the request of the proprietor doesn’t have completely impartial management over the worth.”11).

2. Europe on the Forefront of an Intolerant Shift

Past the opportunistic {qualifications} of varied events and to return extra merely to the way in which the regulation ought to be utilized in a liberal democracy, let’s recall that cryptocurrency transfers are transfers of digital communications in keeping with the definition supplied by European Union regulation12.

Furthermore, cryptocurrencies like Bitcoin or Ethereum enable for the trade of communications that may be certified as correspondences (the probabilities of trade aren’t restricted to financial items). Digital communications are protected by the correct to privateness and private information safety, and a limitation similar to lifting confidentiality or blocking can solely be justified whether it is needed for the efficient pursuit of an outlined goal, in a strictly proportionate method, notably within the case of a confirmed offense and personally dedicated by the person whose communication is proscribed.

The Courtroom of Justice of the European Union has additionally dominated on this sense, contemplating that the systematic evaluation of communications, even when potential, infringes on the elemental proper to the safety of customers’ private information, in violation of the Constitution of Basic Rights of the European Union. The Courtroom specifies that an injunction to dam communications that doesn’t distinguish “between unlawful and authorized content material […] might consequence within the blocking of communications with authorized content material” and thus infringe on the liberty of expression and communication13. Concerning cryptocurrency transfers, we will additionally invoke an infringement on the correct to property.

It’s subsequently inconceivable, in a liberal democracy, to ask a non-public actor to dam transactions or different kinds of communications with out being sure of their illegality.

We are able to notice one other handy schizophrenia on the a part of the American authorities, which Lyn Alden aptly summarizes by referring to “Schrödinger’s Foreign money”14: Bitcoin is taken into account as a forex solely when it permits for the prosecution of people. The remainder of the time, it’s a speculative software to which this qualification is denied. Certainly, to use the definition of “cash transmitter,” it’s needed to contemplate that what’s being transmitted (bitcoins) is certainly cash. To the purpose that the federal government argues that “Bitcoin clearly qualifies as cash” to be able to prosecute Roman Storm.

Europe usually engages on this distortion as nicely, as I had already proven within the justification invoked to incorporate “crypto-assets” within the TFR regulation. Cryptos have certainly appeared in a textual content that beforehand focused solely “banknotes and cash, scriptural cash, and digital cash.” However to say that Bitcoin is a forex…

Furthermore, in Europe, coincidentally, a brand new regulation was voted on April 25 imposing new monetary constraints, nonetheless with the laudable goal of combating cash laundering15.

Among the many constraints, we will notably notice a €10,000 money fee restrict throughout Europe, but additionally the requirement for digital asset service suppliers (DASPs) to gather much more details about their purchasers, together with for transactions beneath €1,000, and for private wallets, often known as “self-custodial,” “self-hosted,” or “un-hosted,” i.e., not managed by a monetary middleman on behalf of third events. The leather-based wallets of the digital world.

A small digression into Newspeak right here: by imposing the terminology “self-hosted” or “un-hosted,” regulators and legislators try to implement the view that third-party custody is the norm, and self-custody is the exception. That is clearly a harmful and insidious view, suggesting that wanting to maintain one’s personal cash is suspicious, despite the fact that it’s a part of the traditional train of freedoms. There aren’t any “un-hosted” or “self-hosted” wallets. There are simply wallets, interval. And there are third events who maintain wallets on behalf of others.

Returning to the textual content, let’s casually notice that it’s notably exact and imposes know-your-customer (KYC) necessities for transactions beneath €1,000 solely on DASPs, exempting banks and different monetary establishments, which deal with far bigger volumes than DASPs. The proportionality of this quantity and this discrimination will not be justified.

As well as, there’s a ban on supporting enhanced privateness cryptocurrencies. Allow us to recall right here that historic commodity monies (gold, silver, copper, bones, and so on.) are nameless, as continues to be money right this moment. The ban is subsequently inequitable and strikes beneath the pretext of its digital nature. It’s once more unjustified, though it unacceptably hinders the traditional train of a freedom since we’re speaking about its outright extinction (such a disproportion will not be admitted by the European Courtroom of Human Rights16).

As beforehand talked about, all these actions are extraordinarily problematic in a number of respects.

First, as a result of these constraints are based mostly on no rational reasoning or related justification and are merely the results of paranoia associated to cryptos, coupled with a KYC mannequin (Know Your Buyer, the shopper identification processes imposed on monetary establishments) that has been elevated to a faith regardless of the shortage of convincing outcomes over a number of a long time. Second, as a result of they disregard the necessities for the safety of basic freedoms on which the European Union was constructed and to which it’s topic. Third, as a result of they’re counterproductive, which means they create new threats, the implications of that are more and more extreme.

3. An Unfounded Paranoia

Almost all texts coping with the “needed” regulation of “crypto-assets” have deserted scientific and authorized rigor to the purpose of by no means proving the preliminary assertion from which their reasoning begins: “cryptos are an excellent means to facilitate cash laundering.”

To understand this, one solely wants to investigate all of the texts on the topic issued in recent times. That is an train I’ve already executed for the TFR textual content17. Certainly, within the “proportionality” paragraph of the proposed modification to the regulation, there’s a small phrase indicating that, in keeping with the opinion of EU surveillance authorities, “particular” risk-increasing elements have been recognized regarding cryptos.

Why is proportionality a particularly vital precept in a state ruled by the rule of regulation?

As a result of the adequacy of a legislative commonplace or instrument to the pursued goal, i.e., the stability between the infringement on a proper and the overall curiosity, is totally essential to keep away from authoritarian and liberty-infringing drifts. One can not conceal behind an goal, nevertheless commendable, to impose disproportionate restrictions on rights.

For instance, one would possibly assume that by putting in a policeman in everybody’s house, crime could be lowered. The target could also be thought of laudable, however the person rights that will be compromised within the course of symbolize an unacceptable discount in freedoms. Thus, society decides to tolerate doubtlessly larger crime charges (topic to the dangers to freedoms generated by surveillance itself) to be able to protect the rule of regulation and basic freedoms, with out which democracy can not exist.

Conversely, the prohibition of alcohol whereas driving is a restriction that may be thought of proportionate: alcohol consumption will not be prohibited, however it’s prohibited in conditions the place its consumption is systematically harmful for oneself and others. The impacts of such laws could be monitored by observing the variety of accidents, for instance. A proper has been restricted, actually, however the common curiosity prevails because the effectiveness of the measure in relation to an vital goal (the preservation of life) could be demonstrated, and the infringement on rights is minimized by limiting the restrictions as a lot as potential.

In a liberal democracy, freedom is the norm and constraints the exception. It’s as much as the state, when it needs to limit a freedom, to show that it doesn’t go additional than needed to realize its goal and that this goal is successfully achieved18. Moreover, the state is obliged to undertake norms to make sure that all individuals and establishments, each private and non-private, respect this rule19.

Within the case at hand (cash laundering and terrorist financing), and regardless of the assertion that “supervisory authorities have recognized particular danger elements,” when one performs the detective wishing to hint again to the supply, one realizes that the opinion in query, relationship from 2019, itself admits that the so-called “competent authorities” would not have the “information and understanding of those merchandise and belongings, which prevents them from finishing up a correct affect evaluation.”20

It additionally deflects by referring to a different opinion (sic) from the European Banking Authority, which dates again to… 2014. On this “unique” opinion, we discover a somewhat laconic evaluation: “the phenomenon of Digital Currencies being assessed has not existed for a enough period of time for there to be quantitative proof out there of the present dangers, neither is this of the standard required for a sturdy rating.”21

In different phrases, the TFR regulation, imposing monitoring of all crypto transfers from one supplier to a different, was constructed on the idea of two experiences. One report said that there was no proof to qualify or quantify the dangers, whereas the opposite admitted that competent authorities lacked the information and understanding to conduct an evaluation.

Subsequently, concluding the paragraph on the “proportionality” of the TFR regulation by stating that “In accordance with the precept of Proportionality as set out in Article 5 of the Treaty on European Union (TEU), this regulation doesn’t exceed what is critical to realize its aims” is questionable at greatest. Because the dangers aren’t assessed, it appears tough to characterize the restriction of rights as “proportionate.”

In his battle towards FINMA, Alexis Roussel made the identical remark for Switzerland. The Swiss Nationwide Danger Evaluation (NRA) of 201822 concerning cash laundering dangers in crypto signifies, from its very first sentence, that no instances of terrorism financing associated to crypto have been recognized, and solely uncommon instances of cash laundering. Nevertheless, the following assertion recommends classifying these belongings as “high-risk” by their very nature. Particularly, which means that a crypto transaction, even of €10, carries the identical stage of danger as a €100,000 switch to an account in Russia. This equivalence is established with out democratic processes in Switzerland and with none proof.

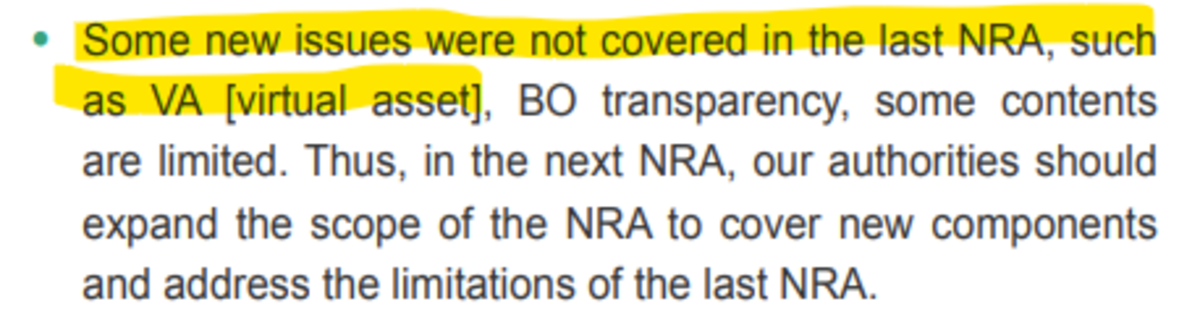

The 2024 NRA23 doesn’t appear to have made a lot progress and nonetheless admits to missing information to evaluate dangers.

We are able to clearly see a sample emerge: anti-money laundering rules and more and more stringent information assortment necessities are imposed with out professional foundation or factual information to justify their implementation.

A extra complete overview has been supplied by L0la L33tz in Bitcoin Journal24, permitting us to complement this stock of breaches of essentially the most fundamental rigor in Europe, in addition to by sister establishments of Bretton-Woods, the IMF, and the World Financial institution, that are true compasses for international decision-makers.

For instance, in 2023, the annual report for 2021 from the European Union’s FSRB (the European department of the Monetary Motion Process Drive, FATF)25, an intergovernmental group established in 1989 to fight cash laundering and terrorism financing, was launched.

The report begins with the next quote: “It’s well-known that cash launderers have abused cryptocurrencies, initially to switch and conceal earnings generated from drug trafficking. These days, their strategies have gotten more and more refined and on a bigger scale.”

Sadly, beginning an argument with “it’s well-known” reads the identical as an essay that begins with “All through historical past, mankind”: it doesn’t exude the rigor of thorough analysis.

The report itself admits {that a} research can be devoted in 2022 to analyzing cash laundering tendencies in cryptocurrencies, suggesting that it didn’t exist on the time of writing the report, asserting as an apparent fact what had by no means been studied.

This report devoted to the research of cash laundering tendencies in cryptocurrencies has certainly been revealed26, nevertheless it focuses not on the phenomenon itself however somewhat on the evaluation of the implementation of rules. Laws that, it’s price noting, are based mostly on unproven cash laundering.

Concerning the research of information and the sphere, the report apparently notes that the danger evaluation “lacks depth.” It additionally observes that almost all of regulators lack the instruments and experience essential to successfully analyze and examine instances of cash laundering and terrorism financing associated to “digital belongings.”

The research additionally takes the identical shortcut because the aforementioned Swiss evaluation: discovering only a few instances of cash laundering involving digital belongings, it prefers to conclude that it’s as a result of extra regulation is required, somewhat than contemplating that cash laundering will not be overrepresented in these belongings.

As for the IMF, it is no higher: the most recent report on public insurance policies associated to crypto-assets (September 2023)27 factors out the shortage of knowledge on cash laundering and terrorism financing dangers, stating that “such impacts haven’t been particularly studied in relation to crypto-assets.”

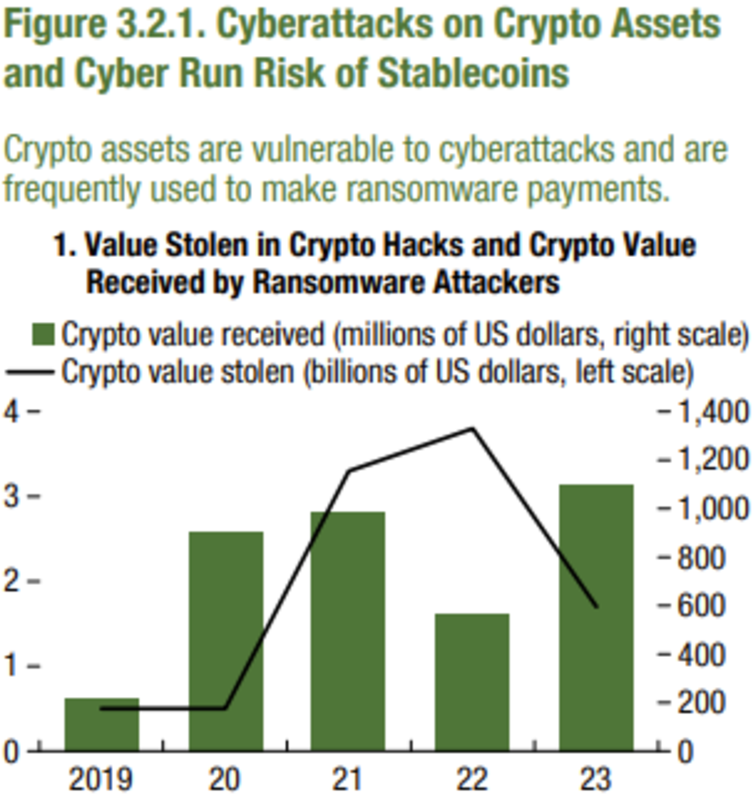

The IMF’s World Monetary Stability Report for 202428 depends on Chainalysis figures and proposes the determine of $1.1 billion acquired in cryptocurrencies for ransomware globally, which is lower than 0.07% of the crypto market capitalization.

The IMF’s twin establishment, the World Financial institution, doesn’t considerably differ from the aforementioned views. In a 2023 report the establishment signifies that the difficulty of “Digital Belongings” was not addressed within the Danger Evaluation and calls on public authorities and corporations to supply extra information concerning these belongings.

In its cash laundering-related publications for 202030 and 202231 the World Financial institution merely makes no point out of cryptocurrencies. In its articles32 33 on crypto adoption, the World Financial institution merely sidesteps the difficulty by redirecting to FATF papers.

We now have come full circle: experiences cite one another, asking for extra readability on the figures, however no one ever conducts the research itself. We depend on FATF, an unelected physique, not topic to the foundations of a good democracy, particularly concerning proportionality, as I discussed earlier.

The target is now not to permit a proportionate battle towards cash laundering however to lift the requirements of controls yearly, forgetting the rationale why these controls have been carried out within the first place.

Furthermore, monetary establishments use the time period “compliance” to emphasise the truth that they adjust to the anticipated management requirements. The aims of effectivity and proportionality are now not at stake. There isn’t a doubt that if FATF really helpful placing a policeman behind each laptop, legislators would rush to transpose this “greatest observe” into regulation…

It is not even hidden. Within the regulation voted on April 24 by the European Union34, the justification for imposing new requirements on crypto corporations is totally not targeted on combating cash laundering and its effectiveness. Certainly, since MiCA has not even entered into power but, and the difference of the TFR textual content to cryptos may be very latest, how might we conduct a posteriori evaluation of the effectiveness of measures that haven’t but had an impact and presumably choose that they must be strengthened?

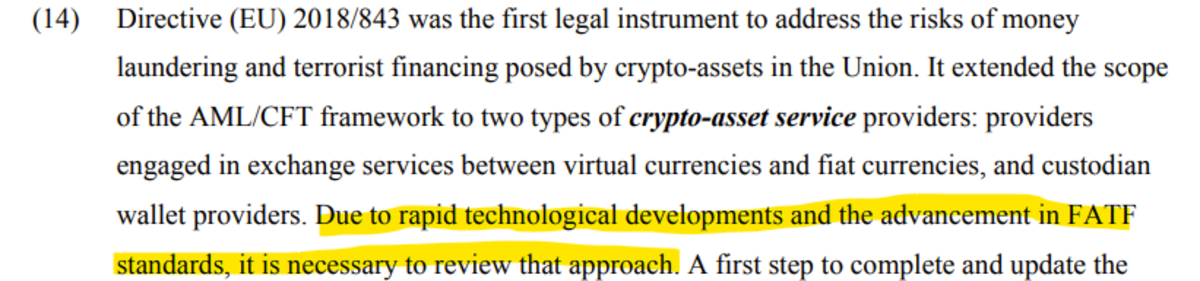

The reasoning behind the strengthening of controls is the truth is a lot less complicated: “Attributable to speedy technological developments and the development in FATF requirements, it’s essential to overview that strategy.”

It isn’t the evolution of the menace, its evaluation, the means utilized by criminals, or the outcomes of a research, and so on., however somewhat the development in FATF requirements that leads Europe to align itself.

And the subsequent steps are already laid out: “On the identical time, advances in innovation, similar to the event of the metaverse, present new avenues for the perpetration of crimes and for the laundering of their proceeds.”

Whereas the most well-liked metaverses are nonetheless within the experimental stage and barely see just a few hundred individuals connecting concurrently, and because the hype subsides, they’re already being talked about as nothing lower than “avenues” for cash laundering.

In the event you’re searching for numbers and analyses, look elsewhere. The imposition of further surveillance requirements depends extra on beliefs and perceptions than on information as a result of nobody dares to oppose as a policymaker, risking being equated with a supporter of terrorism or cash laundering. It is subsequently a real faith, one which turns into nearly unattainable to query at its core.

The digital transition has been enormously helpful for states: with the must be banked to reap the benefits of monetary globalization, resulting in the omnipresence of banks, the variety of potential targets to observe has drastically diminished, till it ended up regarding solely a handful of banks. The transition from a world during which everybody held their money at house to at least one the place, no less than within the OECD, banking is the norm, entails an inevitable monetary intermediation.

On this regard, Bitcoin was an enormous wake-up name as a result of it signifies that your complete monetary regulation of the previous 30 years is out of date, as it’s based mostly on an assumption that’s now not legitimate, specifically the necessity for a monetary middleman to conduct transactions within the digital world.

In tomorrow’s world the place corporations will make wallet-to-wallet funds, who will carry out KYC? Will we solely understand the absurdity of the mannequin when half the planet is working to observe the opposite half?

Bitcoin shakes the very foundations of anti-money laundering efforts. And somewhat than questioning the regulation and its relevance, each when it comes to effectiveness and when it comes to respect for basic freedoms, we favor the trail of blindness, which ends up in proscribing using a technologically impartial software by arbitrarily impeding innovation, the correct to property, and the safety of trade confidentiality, the significance of which for democracy, notably via encryption of exchanges, has not too long ago been reaffirmed by the European Courtroom of Human Rights35.

Bitcoin is a canary within the mine. A sign that one thing is slipping away from us, not regarding cryptocurrencies, however regarding the basic freedoms of all residents, threatened by monetary surveillance.

[1] https://uitspraken.rechtspraak.nl/particulars?id=ECLI:NL:RBOBR:2024:2069

[2] Phil Zimmermann, Why I Wrote PGP, https://www.philzimmermann.com/EN/essays/WhyIWrotePGP.html

[3] François Sureau additionally alerted us on this regard: “This provides nothing to the battle towards terrorism. Quite the opposite, it provides him a victory and not using a battle, by exhibiting how fragile our rules have been. François Sureau, Pour la liberté — Répondre au terrorisme sans perdre la raison, Tallandier, Essais, 2017, p.11.

[4] This tends to show Satoshi Nakamoto proper, who wrote on bitcointalk on December 11, 2010, “WikiLeaks has kicked the hornet’s nest, and the swarm is headed in direction of us.”. He discusses the sudden consideration Bitcoin is receiving following Wikileaks’ announcement that they might settle for bitcoin donations. For Satoshi, this consideration turned a hazard, and this message can be one among his final earlier than disappearing and preserving his anonymity.

[5] US Lawyer’s Workplace Southern District of New York, Founders And CEO Of Cryptocurrency Mixing Service Arrested And Charged With Cash Laundering And Unlicensed Cash Transmitting Offenses, 2024 https://www.justice.gov/usao-sdny/pr/founders-and-ceo-cryptocurrency-mixing-service-arrested-and-charged-money-laundering

[6] FBI, Alert on Cryptocurrency Cash Providers Companies, 2024, https://www.ic3.gov/Media/Y2024/PSA240425

[7] Voir par ex. Florent Latrive, Téléchargement : les logiciels P2P menacés d’interdiction, 3 mai 2006, https://www.liberation.fr/futurs/2006/05/03/telechargement-les-logiciels-p2p-menaces-d-interdiction_37994/ ; Estelle Dumout, Vers une interdiction des logiciels peer-to-peer n’intégrant pas de DRM ?, 1 novembre 2005, https://www.zdnet.fr/actualites/vers-une-interdiction-des-logiciels-peer-to-peer-n-integrant-pas-de-drm-39286440.htm.

[8] Voir par ex. The Kazaa Ruling: What It Means, 2 avril 2002, https://www.wired.com/2002/04/the-kazaa-ruling-what-it-means/ ; Christophe Guillemin, La Cour de cassation néerlandaise confirme la légalité de Kazaa, 22 déc. 2003, https://www.zdnet.fr/actualites/la-cour-de-cassation-neerlandaise-confirme-la-legalite-de-kazaa-39134304.htm.

[9] Gérard Glaise, La responsabilité des distributeurs de logiciels de peer-to-peer : l’exemple du canari dans la mine?, 14 oct. 2004, https://www.droit-technologie.org/actualites/la-responsabilite-des-distributeurs-de-logiciels-de-peer-to-peer-lexemple-du-canari-dans-la-mine/.

[10] Lionel Thoumyre, Peer-to-peer : un « audiopathe » partageur relaxé pour bonne foi, 17 juillet 2006, https://www.juriscom.web/wp-content/paperwork/da20060717.pdf.

[11] Madison Park, 90 p.c of U.S. payments carry traces of cocaine, https://version.cnn.com/2009/HEALTH/08/14/cocaine.traces.cash/

[12] Damian Williams, The Authorities’s Opposition To Defendant Roman Storm’s Pretrial Motions, 2024, https://storage.courtlistener.com/recap/gov.uscourts.nysd.604938/gov.uscourts.nysd.604938.53.0.pdf

[13] FinCen, Utility of FinCEN’s Laws to Digital Foreign money Software program Improvement and Sure Funding Exercise, 2014, https://www.fincen.gov/sources/statutes-regulations/administrative-rulings/application-fincens-regulations-virtual

[14] FinCen, Utility of FinCEN’s Laws to Sure Enterprise Fashions Involving Convertible Digital Currencies, 2019, https://www.fincen.gov/websites/default/information/2019-05/FinCENpercent20Guidancepercent20CVCpercent20FINALpercent20508.pdf

[15] Directive 2018/1972 établissant le Code des communications électroniques européen, artwork. 2.

[16] Cour de Justice de l’Union européenne, Communiqué de presse n° 126/11, 24 nov. 2011, à propos de l’affaire Scarlet Prolonged SA, https://curia.europa.eu/jcms/add/docs/utility/pdf/2011-11/cp110126fr.pdf.

[17] https://twitter.com/LynAldenContact/standing/1784304037430456383

[18] Anti-Cash Laundering Regulation EU, 2024, https://www.europarl.europa.eu/doceo/doc/TA-9-2024-0365_EN.pdf

[19] Jeremy McBride, , « Proportionality and the European Conference on Human Rights », in The precept of Proportionality within the Legal guidelines of Europe, éd. Evelyn Ellis, Hart Publishing, 1999, p. 25 ; Cour EDH. Hertel c. Suisse, 25 août1998, §50, https://hudoc.echr.coe.int/?i=001-62778.

[20] https://twitter.com/StachAlex/standing/1776914160355303883

[21] Groupe de travail « Article 29 », avis 01/2014, n°3.26 (et jurisprudence citée).

[22] Cour EDH, X. et Y v. Pays Bas, 26 mars 1985, https://hudoc.echr.coe.int/?i=001-62162.

[23] Joint Opinion of the European Supervisory Authorities on the dangers of cash laundering and terrorist financing affecting the European Union’s monetary sector, 2019, https://register.eiopa.europa.eu/Publications/Jointpercent20Opinionpercent20onpercent20thepercent20riskspercent20onpercent20MLpercent20andpercent20TFpercent20affectingpercent20thepercent20EUspercent20financialpercent20sector.pdf

[24] EBA Opinion on ‘digital currencies’, 2014, https://extranet.eba.europa.eu/websites/default/paperwork/information/paperwork/10180/657547/81409b94-4222-45d7-ba3b-7deb5863ab57/EBA-Op-2014-08percent20Opinionpercent20onpercent20Virtualpercent20Currencies.pdf?retry=1

[25] Federal Division of Justice and Police of Switzerland, Nationwide Danger Evaluation (NRA):Danger of cash laundering and terrorist financing posed by crypto belongings and crowdfunding, 2018, https://www.sif.admin.ch/dam/sif/en/dokumente/IntegritpercentC3percentA4tpercent20despercent20Finanzplatzes/nra-bericht-krypto-assets-und-crowdfunding.pdf.obtain.pdf/BC-BEKGGT-d.pdf

[26] Federal Division of Justice and Police of Switzerland, Nationwide Danger Evaluation (NRA) Danger of cash laundering and the financing of terrorism via crypto belongings, 2024, https://www.newsd.admin.ch/newsd/message/attachments/86329.pdf

[27] Lola Leetz, EU Parliament Adopts AML Legal guidelines Regulating Bitcoin Based mostly on Questionable Assumptions, 2024 https://bitcoinmagazine.com/authorized/eu-parliament-adopts-aml-laws-regulating-bitcoin-based-on-questionable-assumptions

[28] Council of Europe, Annual Report 2021 MoneyVal, https://rm.coe.int/0900001680aad1fc

[29] Council of Europe, Cash Laundering And Terrorist Financing Dangers In The World of Digital Belongings, 2023, https://rm.coe.int/0900001680abdec4

[30] Monetary Stability Board, MF-FSB Synthesis Paper: Insurance policies for Crypto-Belongings, 2023 https://www.fsb.org/wp-content/uploads/R070923-1.pdf

[31] FMI, World Monetary Stability Report, The Final Mile : Monetary Vulnerabilities and Dangers, 2024, https://www.imf.org/en/Publications/GFSR/Points/2024/04/16/global-financial-stability-report-april-2024

[32] World Financial institution Group, Classes Discovered from the First Era of Cash Laundering and Terrorist Financing Danger Assessments, 2023, https://openknowledge.worldbank.org/server/api/core/bitstreams/2e1f3f32-57ad-43cb-bb8e-d1aab5636be4/content material

[33] World Financial institution Group, Matthew Collin, Illicit Monetary Flows: Ideas, Measurement, and Proof, 2019, https://openknowledge.worldbank.org/server/api/core/bitstreams/d2f7fa07-a285-5c5b-880e-25002a4951fb/content material

[34] World Financial institution Group, Nationwide Assessments of Cash Laundering Dangers: Studying from Eight Superior Nations’ NRAs, 2022, https://openknowledge.worldbank.org/server/api/core/bitstreams/b860c956-659e-5005-93c9-4f06993c37ab/content material

[35] World Financial institution Group, Crypto-Belongings Exercise across the World Evolution and Macro-Monetary Drivers, 2022, https://documents1.worldbank.org/curated/en/738261646750320554/pdf/Crypto-Belongings-Exercise-around-the-World-Evolution-and-Macro-Monetary-Drivers.pdf