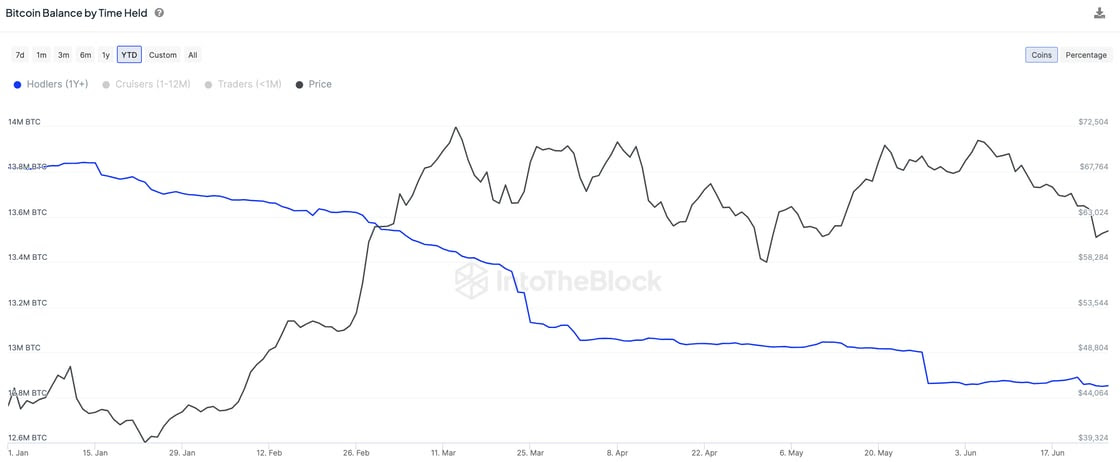

Might 2024 emerges as a pivotal month for Bitcoin, witnessing a notable quantity of liquidation by long-term holders. Blockchain analytics agency IntoTheBlock highlighted a sell-off totaling roughly $10 billion, equal to roughly 160,000 BTC.

This pattern marked a major departure from the standard holding patterns seen amongst long-term buyers, who usually assist stabilize Bitcoin costs by holding by way of volatility.

Bitcoin Stability at Threat?

Notably, these long-term Bitcoin holders, often known as the stalwarts of the Bitcoin group, have historically served as a bulwark in opposition to market turbulence, with their funding selections usually reflecting a steadfast perception within the cryptocurrency’s long-term worth.

The change of their habits in Might alerts a broader sentiment shift inside the market. The dimensions of this sell-off not solely underscores a potential loss of religion or a strategic monetary recalibration but additionally poses severe implications for market liquidity and value stability.

IntoTheBlock’s evaluation additional reveals a slowdown in June, with “solely” 40,000 BTC bought, suggesting that whereas the fevered tempo of Might’s sell-offs has cooled, the liquidation pattern persists. Such continued promoting exercise contributes to ongoing value pressures, difficult the resilience of Bitcoin’s market worth.

The repercussions of those large-scale disposals lengthen past easy transactional impacts. Bitcoin’s value has struggled to seek out agency footing above the $61,000 mark, with frequent fluctuations testing the resolve of each merchants and analysts.

Regardless of temporary spikes in buying and selling exercise—similar to a surge to $62,314 earlier at present—Bitcoin’s value has retracted to round $60,843, reflecting a 1.3% lower over the previous day.

Adjusting to New Realities

Including to the complexity is the numerous discount in Bitcoin mining exercise. After the Halving occasion in April, which lowered mining rewards by half, there was a marked lower in mining output.

Information from CryptoQuant signifies a close to 90% drop in miner withdrawals, suggesting a drastic reduce in promoting stress from this quarter. The lowered mining exercise is essentially attributable to decreased profitability, prompting miners to reduce operations and promote fewer cash.

This adjustment may usually recommend a tightening of provide and potential upward stress on costs, but the overarching market sentiment stays bearish.

CryptoQuant evaluation factors to a state of “capitulation” amongst miners, a situation supported by the Hash Ribbons metric indicating that the short-term mining hash price has fallen beneath its longer-term pattern.

Usually, merchants think about such alerts bullish, indicating potential shopping for alternatives. Nonetheless, the present market digestion of the current heavy sell-offs by long-term holders and the discount in mining output paints a extra nuanced image.

The convergence of those elements may but forge a pathway out of the present bearish local weather, setting the stage for a potential market restoration.

Featured picture created with DALL-E, Chart from TradingView