The crypto world is at present abuzz with the launch of EigenLayer’s new token, EIGEN, which has rapidly turn out to be one of many yr’s most anticipated digital asset occasions.

In response to Bloomberg, the undertaking has attracted important consideration for its method to decentralized finance (DeFi) and its “controversial” determination to exclude customers from sure jurisdictions, together with the US, China, and Canada, from taking part within the token distribution.

EigenLayer Challenges And Alternatives in Token Distribution

EigenLayer, a DeFi protocol based mostly in Seattle, has made waves within the trade by introducing an idea often called restaking. This methodology goals to extend rewards on the Ethereum blockchain by permitting customers to deposit ETH to assist function the community.

In response to information from DeFiLlama, since its debut in 2023, EigenLayer has attracted over $15 billion in belongings, demonstrating the numerous curiosity and potential of this new method.

The launch of the EIGEN token is ready to start with an airdrop, a course of the place tokens are distributed to customers based mostly on sure standards, together with a factors system that rewards early service adopters.

Kunal Goel, an analyst at Messari, famous that anticipating this airdrop was a “major incentive” for customers to put funds in EigenLayer’s service.

Nonetheless, the thrill has been tempered by the truth that many individuals who gathered factors at the moment are barred from claiming their tokens as a consequence of utilizing digital non-public networks or residing in excluded international locations.

Robert Drost, govt director on the Eigen Basis, defined that the exclusions had been a obligatory step to stick to regulatory pointers, which are sometimes unclear and difficult to navigate, noting:

It’s not attainable to function within the house with out following regulatory pointers and being accountable, and the difficult half is that there’s not a variety of readability.

This sentiment was echoed by Nick Cote, co-founder of Secondlane, who famous:

Issuers not being upfront with jurisdictional restrictions leaves a bitter style in folks’s mouth when it comes time to receiving your rewards, and then you definately discover out you’re disqualified for X, Y, Z motive.

Impression On The Broader DeFi Ecosystem

EigenLayer’s restaking service is not only a brand new function within the Ethereum ecosystem; it represents a shift in how purposes can leverage the deep pool of transaction validators that underpin Ethereum.

This service will increase the yield from staking ETH – from a baseline of round 3% to greater charges, albeit with extra dangers.

Consequently, EigenLayer has risen to turn out to be the “second hottest DeFi software,” as reported by Bloomberg, partly on the expense of liquid staking protocols like Lido and Rocket Pool, which have seen important outflows in current months.

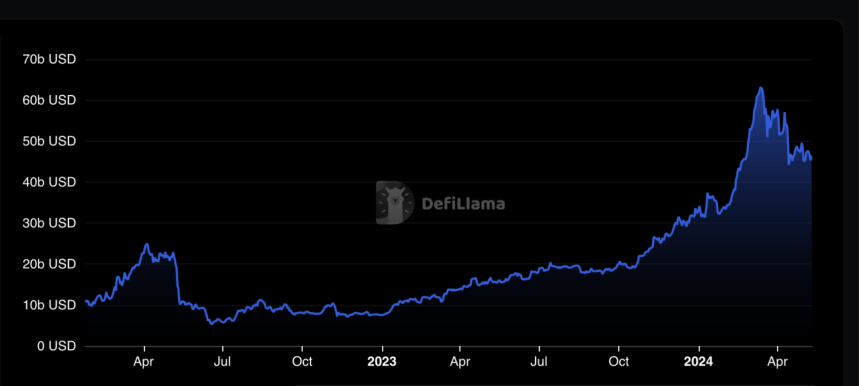

In response to DeFiLlama, liquid staking protocols have skilled a greater than 20% decline in whole worth locked since their notable excessive above $63 billion in March.

In the meantime, in keeping with a current report from IntoTheblock, practically 4% of all ETH is now restaked utilizing EigenLayer, showcasing the undertaking’s rising recognition.

EigenLayer lately surpassed $15B in TVL.

Practically 4% of all ETH, and 40% of liquid staking tokens (LSTs) provide is at present being restaked into EigenLayer pic.twitter.com/LZ0vbp3L3z

— IntoTheBlock (@intotheblock) April 26, 2024

Featured picture from Unsplash, Chart from TradingView