Table of Contents

For anybody with substantial bitcoin holdings, a custody construction that features a single level of failure needs to be seen as unacceptable. If a pockets has a single part that—when misplaced or stolen—can result in a everlasting lack of funds, then it’s just too harmful to contemplate. No one desires to maintain vital wealth teetering on the sting of disaster.

Particular person bitcoin holders have quite a few instruments obtainable that may assist scale back the chance of loss or theft. In a earlier article, we coated a few of these instruments, highlighting modifications generally utilized to singlesig wallets. Nevertheless, we additionally defined why these approaches fall in need of eradicating single factors of failure totally.

For a enterprise, authorities, or different establishment that desires to safe a bitcoin treasury, eliminating single factors of failure is not only a nice-to-have, however a prerequisite. The one custody fashions price contemplating for these entities are ones that embrace a threshold requirement with a purpose to entry funds. A threshold requirement describes a construction that includes a number of, individually secured elements, the place a subset of these elements are wanted to approve any withdrawal. That is the one approach of reaching institutional-grade safety, with single factors of failure eradicated utterly.

On this article, we’ll cowl the best way to apply threshold safety utilizing three totally different strategies: script multisig, Shamir’s secret sharing (SSS), and multi-party computation (MPC). We’ll additionally dive into the tradeoffs related to every strategy, and the way an establishment can select one of the best setup to fulfill their wants.

What’s multisig?

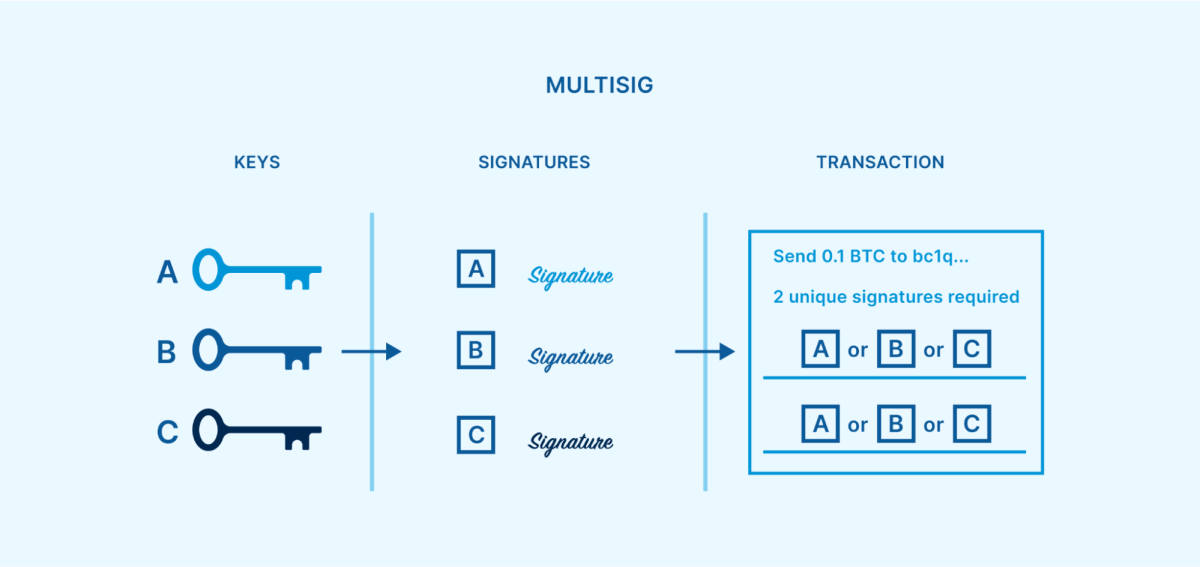

Should you aren’t positive what script multisig is, we advocate testing our earlier article devoted to explaining how multisig wallets work and what they’re used for. As a fast assessment, a multisignature pockets includes a number of personal keys, and might be configured so {that a} particular quantity (threshold) of these personal keys are required to signal any transaction. The signatures might be produced at totally different instances and places, permitting every key to stay bodily separated. As soon as a threshold variety of signatures have been produced, they are often mixed right into a single bitcoin transaction able to spending the funds.

This comparatively easy approach of making a threshold requirement is very efficient at eradicating all single factors of failure. So long as the spending threshold is larger than one however lower than the full variety of keys, then any single key can turn into misplaced, stolen or destroyed with out bitcoin changing into unrecoverable. The remaining keys might signal a restoration transaction shifting funds to a contemporary multisig setup.

Satoshi Nakamoto laid the groundwork for multisig when bitcoin was first launched, anticipating that it might be a well-liked mechanism for securing funds. Nevertheless, it wasn’t till the P2SH softfork in 2012 that multisig began to turn into a broadly used software. Multisig has since confirmed itself as a battle-tested safety mannequin for greater than a decade, throughout a number of totally different tackle sorts.

What’s Shamir’s secret sharing?

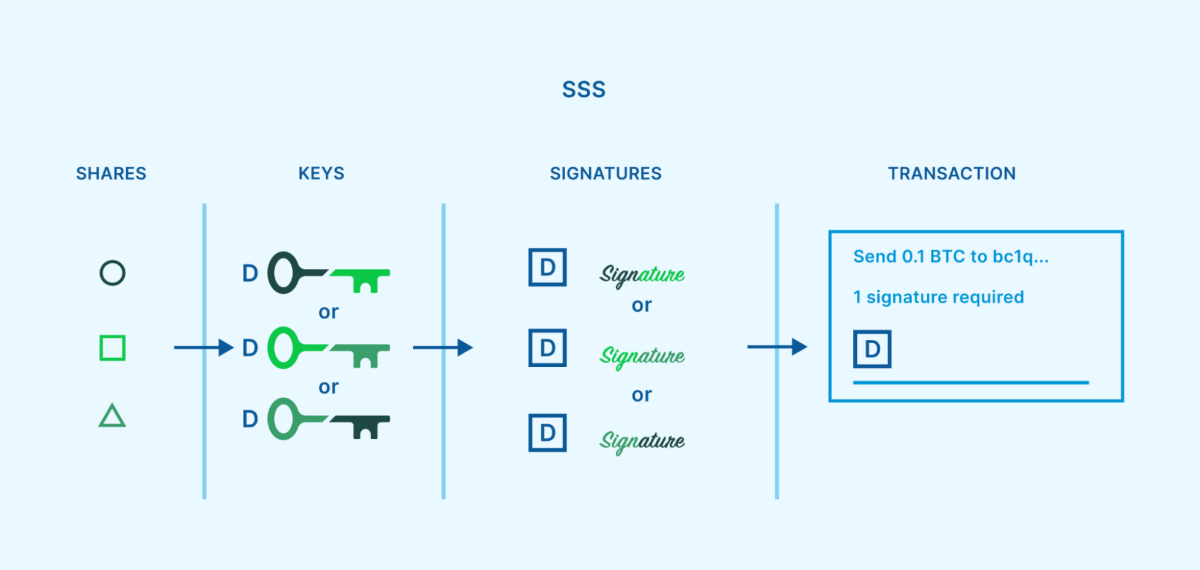

Shamir’s secret sharing (SSS) is a secret sharing algorithm that was developed by famend cryptographer Adi Shamir in 1979. It may be used as one other approach of introducing a threshold requirement for shielding bitcoin. SSS permits customers to separate a key into a number of distributed “shares,” with solely a sure threshold of the shares wanted to reassemble the important thing. This can be utilized to design quorums like 2-of-3 or 3-of-5, much like multisig.

Nevertheless, this strategy nonetheless results in single factors of failure at sure situations throughout its lifecycle. One instance is when the secret’s initially cut up up into SSS shares. This operation is normally executed on a single machine at a single time and place. If an attacker compromises that machine, the important thing technology course of or the share creation course of, they’ve compromised the important thing. One other instance is every time the consumer must reassemble the important thing to signal a transaction. A threshold variety of shares have to be introduced collectively, as soon as once more on a single machine at a single time and place, which an attacker might exploit.

A reasonably easy and broadly used methodology of implementing SSS know-how for cryptocurrency custody is thru the Shamir backup, developed by Satoshi Labs in 2017. It may be discovered as an possibility in sure Trezor {hardware} pockets fashions.

What’s MPC?

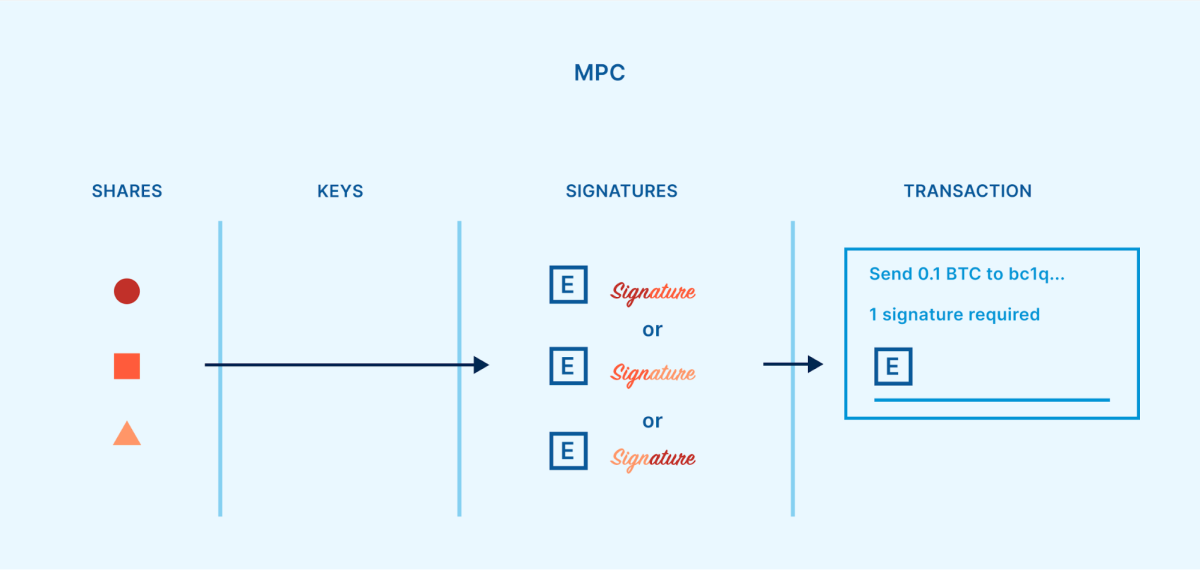

MPC, or multi-party computation, is a subfield of cryptography that traces again to the Nineteen Seventies. The objective of MPC is to permit a number of individuals to collectively carry out a computation, whereas every participant’s contribution to the computation shouldn’t be revealed to the remainder of the group and due to this fact can stay personal. This enables for a number of events to collaborate in varied contexts without having to belief one another.

When utilized to bitcoin custody, MPC includes distributed “shares,” much like SSS. Nevertheless, not like SSS, the shares should not cut up from a personal key nor used to rebuild a personal key. As an alternative, a number of events compute a single signature instantly from a threshold of their shares.

In contrast to SSS, MPC doesn’t necessitate a single level of failure. MPC shares might be generated individually from each other, they usually by no means should be introduced collectively to function the pockets. Info produced from a share might be communicated to the opposite individuals, with out the share itself being revealed.

Since bitcoin and different cryptocurrencies have primarily used a signature system primarily based on ECDSA (Elliptic Curve Digital Signature Algorithm), MPC needed to be tailored for this context. The primary sensible threshold protocols for ECDSA had been printed in 2018. [GG18, LNR18]

What are the trade-offs between threshold fashions?

With three totally different threshold safety fashions to select from, the following step is knowing the strengths and weaknesses of every possibility.

Tradeoffs with multisig

Script multisig is a standardized approach of reaching threshold safety, native to the bitcoin protocol. The construction is taken into account comparatively easy and strong. The barrier to entry can be small—if a bitcoin consumer is aware of the best way to function a singlesig pockets, then it’s not a big leap to learn to arrange and use a multisig pockets.

When a multisig pockets is initialized, the addresses produced for receiving bitcoin into the pockets have the brink requirement constructed into them. As soon as a multisig tackle has been funded, the bitcoin is protected by an immutable contract that has basically been written into the blockchain itself. The one approach to alter the contract (reminiscent of altering the entry management coverage, adjusting which keys are defending the bitcoin) is to maneuver the bitcoin to a brand new tackle that was constructed with a special contract. For a number of events who’re collaborating to safe bitcoin, this ground-level immutable contract mechanism can present the best diploma of reassurance that the cash is secured in accordance with how all events have meant. If something had been to be basically modified, it might turn into apparent to everybody by the prevalence of a public transaction, and the keys that permitted the change can be recognized. For this reason collaborative custody suppliers reminiscent of Unchained depend on script multisig for our merchandise.

Nevertheless, deploying contracts publicly on the blockchain comes with tradeoffs. As bitcoin is spent out of a multisig tackle, the entry management coverage for that tackle have to be completely printed on the blockchain. Observers can then see the small print of the multisig quorum that was getting used. Though the remaining funds might be simply migrated to a brand new tackle going ahead, the truth that previous safety preparations are uncovered isn’t splendid. Moreover, needing to maneuver bitcoin from one tackle to a different with a purpose to modify the entry management coverage implies that transaction charges are all the time concerned with the method (and the bigger the quorum, the dearer it will likely be).

For entities that worth custodying altcoins, reminiscent of cryptocurrency exchanges, script multisig can pose extra of a problem than the opposite two strategies of threshold safety. It’s because a multisig threshold quorum is imposed on the blockchain degree, and totally different cryptocurrencies use totally different blockchains. Many cryptocurrencies don’t even help a local, strong multisig implementation in any respect. In the meantime, SSS and MPC implement threshold quorums on the key degree, and appear like singlesig transactions publicly. Since nearly all cryptocurrencies help an identical normal for singlesig custody (the identical key can be utilized throughout most cryptocurrencies), this enables SSS and MPC to be extra cross-chain suitable.

Tradeoffs with Shamir’s secret sharing

SSS provides one other approach of designing a threshold requirement primarily based on comparatively easy and battle-tested cryptography. For the needs of cryptocurrency custody, SSS additionally has a broadly deployed methodology with a low barrier to entry (Shamir backup). As soon as somebody has expertise utilizing a standard singlesig pockets, it isn’t an enormous leap to make use of a Trezor to arrange a pockets with a Shamir backup.

In contrast to multisig, SSS operates utterly outdoors of public-facing addresses and transactions on the blockchain. As an alternative, the brink requirement is determined by how the personal secret is cut up into shares. Which means that splitting a key into shares and later reassembling them might be executed in personal, in order that solely the folks collaborating within the bitcoin custody association are conscious that SSS is getting used. Along with privateness benefits, retaining the brink construction outdoors of the blockchain additionally implies that SSS transactions received’t result in elevated charges, and it may be used to safe many various cryptocurrencies. Though most cryptocurrencies have their very own distinctive blockchains, they’ll all share the identical personal key as an entry level, and that key can in flip be cut up up utilizing SSS.

The largest drawback to SSS has already been talked about above—the personal key should exist in a single place at one time, earlier than it’s first cut up into shares, and likewise when the shares are recombined for the needs of approving a withdrawal. These vulnerabilities create momentary single factors of failure, which means that SSS by itself doesn’t provide really institutional-grade safety, not like multisig or MPC.

Moreover, SSS doesn’t natively provide a technique for adjusting the entry management coverage. As soon as a personal secret is cut up right into a quorum of shares, these shares will all the time preserve the flexibility to breed that key. If a gaggle is securing a treasury collectively utilizing SSS and a member of the group leaves, revoking permissions for that particular person in a safe method can pose a problem. Remaining members of the group might reassemble the important thing after which cut up it into new shares, however the previous shares would should be verifiably destroyed. In any other case, the funds would should be despatched to a completely new pockets protected by a special key.

Tradeoffs with MPC

Very like SSS, MPC enforces the brink requirement on the key-level as an alternative of the blockchain-level. This unlocks comparable benefits, reminiscent of granting a better capability for privateness, avoiding elevated transaction charges, and permitting for one MPC custody construction for use throughout many various cryptocurrencies.

Importantly, MPC manages to keep away from the momentary single factors of failure that include utilizing SSS. Through the use of a special cryptographic methodology, the important thing shares can exist individually from the second the pockets is first created, and even stay separate whereas signing withdrawal transactions. Most MPC implementations additionally embrace a local methodology of adjusting the entry management coverage (creating a brand new quorum of shares) with out having to ship funds to a brand new pockets tackle.

Nevertheless, MPC for threshold ECDSA is taken into account very complicated cryptography, and there’s not an agreed-upon normal for utilizing it. There are numerous totally different protocols, with the primary two being developed independently in 2018 by Gennaro and Goldfeder [GG18] and Lindell et al. [LNR18]. Since then, we’ve additionally seen protocols from Doerner et al. [DKLs19], Castagnos et al. [CCL+20], Damgård et al. [DJM+20], Canetti et al. [CMP20], Gągol et al. [GKSS20], Gennaro and Goldfeder [GG20], Canetti et al. [CGG+21], Abram et al. [ANO+21], Doerner et al. [DKLs23], and maybe others. Whereas the newer protocols are inclined to make sure enhancements upon the older ones, they might have had much less alternative for peer-review, audit, and different testing.

The upper degree of complexity concerned with MPC creates a widened assault floor. With further elements and procedures, there’s extra room for error and potential safety vulnerabilities. Proof of great safety flaws, together with full personal key extraction assaults, has already offered itself greater than as soon as, affecting among the threshold ECDSA protocols listed above.

Examples embrace:

AS20 vulnerabilities, September 2020, affecting GG18 implementations

Alpha-Rays vulnerabilities, December 2021, affecting GG18 and GG20

TSSHOCK vulnerabilities, August 2023, affecting GG18, GG20, and CGG+21

BitForge vulnerabilities, August 2023, affecting GG18 and GG20

“Cryptography must go the take a look at of time to realize longevity, and these new protocols clearly didn’t go the take a look at of time[…] this analysis was not prepared for implementation or widespread adoption. From my perspective, implementing and productizing such current analysis is kind of harmful.” — Ledger CTO Charles Guillemet, December 2021 response to Alpha-Rays

“[MPC is] extra difficult, extra to get fallacious. Superior crypto protocols are fragile within the element and within the implementation. I might really feel extra assured in multisig, which is tremendous easy and rock strong.” — Put up by famend cryptographer Adam Again, January 2023

MPC can be restricted by who can realistically use it within the first place. As beforehand talked about, threshold ECDSA could be very difficult. For the common particular person, there are not any instruments obtainable to securely or simply arrange MPC independently. Whereas some companies provide collaborative custody MPC wallets which are pretty straightforward to make use of, these companies provide no straightforward approach for customers to get better funds if the enterprise disappears (or no approach in any respect, by which case they’re a single level of failure). As a result of script multisig is an easy and open normal, companies who present collaborative custody options utilizing multisig can provide open-source and easy-to-use restoration instruments. This creates a simple avenue for purchasers to get better their funds even when the collaborative multisig enterprise had been now not obtainable to help.

Which mannequin is greatest?

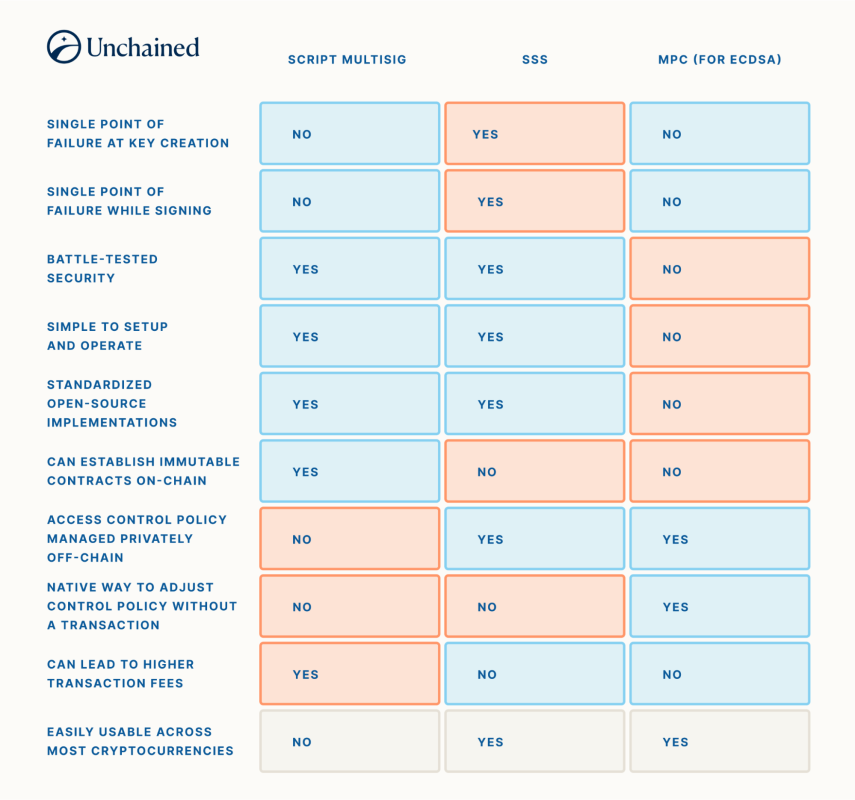

As we simply coated, there are quite a few tradeoffs between utilizing multisig, SSS, and MPC. They are often organized in a chart for a visible comparability:

If a enterprise specializes within the custody of many various cryptocurrencies, they may be motivated to rent a group of execs to rigorously arrange an MPC custody mannequin. Nevertheless, if a enterprise or particular person had been searching for a easy and dependable approach to safe bitcoin for the long run, utilizing script multisig and accepting the privateness tradeoffs may be preferable. SSS isn’t utilized by itself as a consequence of its lack of ability to implement institutional-grade threshold necessities always.

Combining fashions for collaborative custody

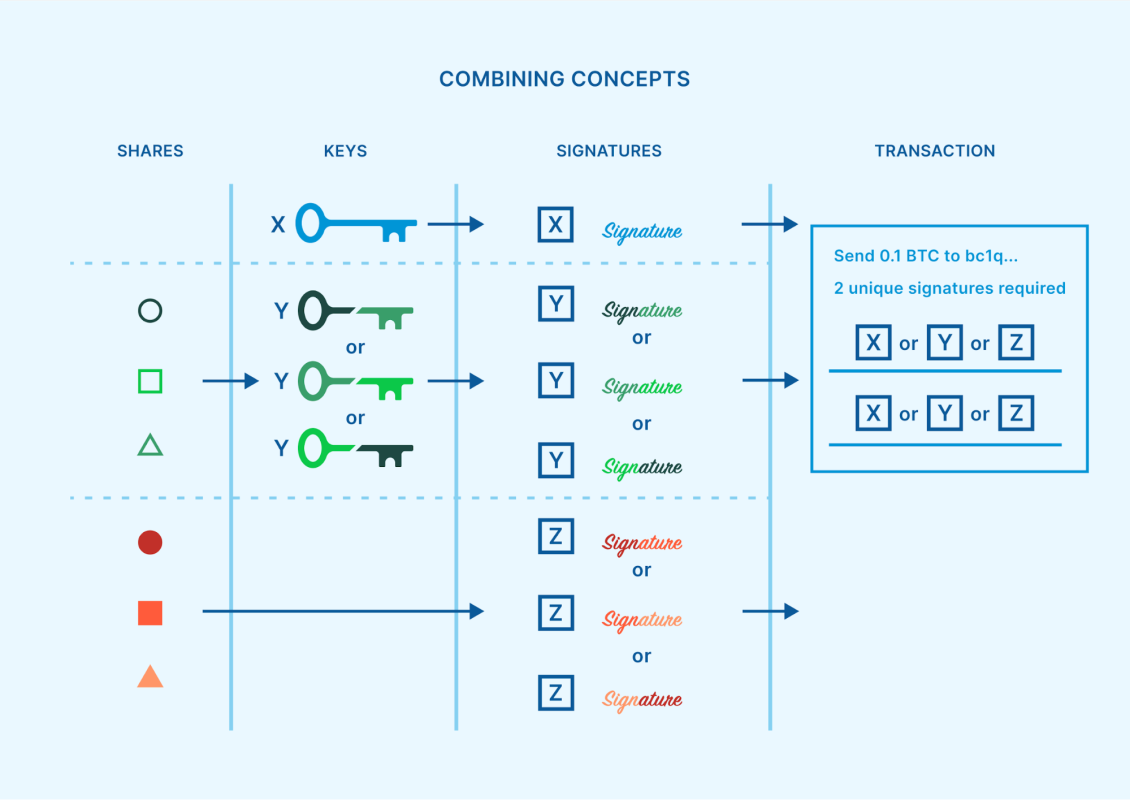

Whereas multisig, SSS, and MPC are sometimes considered competing safety fashions, it’s attainable to include a couple of of them into an total custody construction. As beforehand described, SSS and MPC enable a threshold of key shares to supply a signature for a transaction. If the signature was for spending funds out of a singlesig pockets, then nothing else can be required to finish the transaction. Nevertheless, if as an alternative the signature was for spending funds out of a multisig pockets, further signatures from different keys is also wanted.

Whereas this mixture of methods could sound pointless and cumbersome, there are certainly some contexts the place it makes sensible sense. With the rise in reputation of key brokers and multi-institution custody, there’s a rising variety of specialty companies which are commissioned by people and establishments to safe one of many keys to a multisig pockets. These distributed key brokers may help scale back custodial threat. However how ought to a key agent safe that single key which they’re liable for?

SSS or MPC generally is a technique to reduce or take away single factors of failure from this obligation. A company key agent can design a system the place a number of totally different officers throughout the enterprise every maintain key shares, and due to this fact a signature can solely be produced upon settlement from a threshold of these officers. Moreover, if an assault had been to happen throughout an SSS reassembly, or an MPC implementation finally ends up affected by a brand new key extraction vulnerability like those listed earlier, then no buyer funds are instantly in danger. The important thing agent would have time to react and tackle the difficulty, whereas the bitcoin stays protected by the broader multisig pockets.

Utilizing script multisig to create a threshold requirement as a foundational immutable contract, after which commissioning skilled key brokers to every defend a multisig key utilizing their very own SSS or MPC threshold, is way and away the most secure methodology for an establishment to maintain bitcoin secured for the long-term.

New capabilities with Taproot

In November of 2021, the Taproot soft-fork occurred, including new instruments into the bitcoin ecosystem. A few of these instruments impression the way forward for institutional-grade bitcoin custody, by permitting for sure enhancements and optionalities.

- Schnorr signatures: The Schnorr signature algorithm is now obtainable in bitcoin as an alternative choice to ECDSA. Utilizing MPC on high of Schnorr results in threshold safety schemes which are far simpler, and due to this fact additionally present increased confidence of their safety, in comparison with the ECDSA protocols talked about earlier. FROST is the main Schnorr threshold signature protocol, whereas MuSig2 can be obtainable particularly for N-of-N quorums. Each of those signature schemes are on the trail to changing into standardized instruments throughout the bitcoin business, and they’re anticipated to make MPC obtainable for normal people, with a consumer expertise much like script multisig.

- Script kind privateness: Pay-to-Taproot (P2TR) addresses are a brand new tackle kind that enable script multisig bitcoin addresses to seem similar to the addresses getting used for singlesig wallets. This supplies a big privateness enchancment, as a result of it implies that the bitcoin tackle itself doesn’t present any clues about its proprietor’s safety mannequin, reminiscent of whether or not or not they may be utilizing script multisig.

- A number of spending paths: P2TR addresses even have the flexibility to comprise a number of spending paths constructed into them. This may create new methods of structuring threshold safety for institutional-grade custody, as described in BIP 342 (rationale, part 5). For instance, a consumer might create an N-of-N script multisig spending path for each mixture of keys that may spend funds. Relatively than construct a 2-of-3 quorum with keys A, B, and C, an identical end result might be achieved with three separate 2-of-2 quorums as attainable spending paths—one with keys A and B, one with keys A and C, and one with keys B and C. This technique can improve privateness, as a result of solely the spending path that finally ends up getting used will probably be revealed. An identical idea might be utilized to MPC key share quorums, permitting MuSig2 to be utilized for thresholds.

These Taproot instruments are comparatively new, and their adoption remains to be within the early levels. Many bitcoin softwares and providers don’t but provide full help for what Taproot has to supply. It’s additionally price noting that almost all altcoins don’t have these instruments natively obtainable.

Last ideas

A rising variety of establishments have gotten enthusiastic about securing a bitcoin treasury, they usually require efficient options. Avoiding single factors of failure and minimizing counterparty threat are paramount issues. One of the best ways to fulfill these standards is by leveraging a multisig construction, the place keys might be distributed amongst varied enterprise key brokers, none of whom may have unilateral management over the bitcoin. Every key agent can use SSS or MPC so as to add additional threshold safety for his or her explicit key.

Unchained has pioneered an enterprise custody community, constructed for institutional purchasers who need to arrange an association like this. It’s straightforward to make use of and customizable, so that every shopper will get to decide on whether or not they’d like to carry a controlling variety of keys themselves, or only a single key, or go away the duty of securing keys totally as much as the a number of, unbiased enterprise key brokers. Should you’re enthusiastic about studying extra, schedule a free session with us as we speak!

Particular due to Dhruv Bansal for reviewing this text and offering worthwhile suggestions.

Initially printed on Unchained.com.

Unchained Capital is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed by way of Bitcoin Journal. For extra info on providers supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.