The demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their current approval on January 10, with BlackRock’s IBIT Bitcoin ETF main the way in which. This ETF has reached spectacular milestones in lower than two months, attracting vital investor curiosity and opening doorways for numerous market individuals to put money into the most important cryptocurrency immediately.

As institutional and retail buyers flock to those new funding autos, market specialists predict a bullish development and anticipate a possible worth surge.

Bitcoin ETF Frenzy

In accordance to Bloomberg ETF knowledgeable Eric Balchunas, BlackRock’s IBIT Bitcoin ETF has rapidly joined the esteemed “$10 billion membership,” reaching the milestone quicker than some other ETF, together with Grayscale’s Bitcoin Belief (GBTC), noting that solely 152 ETFs out of three,400 have crossed the edge.

Balchunas notes that IBIT’s ascent to this membership was primarily pushed by vital inflows, which accounted for 78% of its property underneath administration (AUM). This displays the rising urge for food for Bitcoin publicity amongst buyers searching for diversified and controlled funding choices.

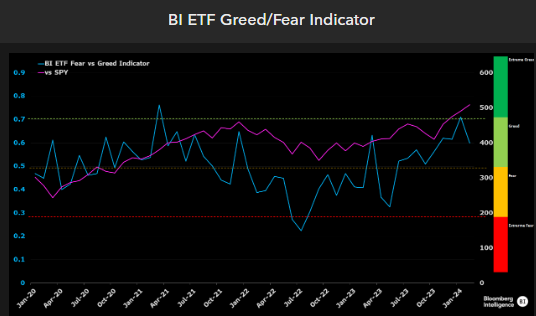

Specifically, the present trajectory of the ETF market paints an image of resilience and bullish sentiment available in the market. Fairness ETF flows, and leveraged buying and selling ranges are optimistic indicators, though they haven’t but reached the euphoria seen in 2021, Balchunas notes.

Nonetheless, Bloomberg’s new BI ETF Greed/Worry Indicator, which includes numerous inputs, highlights the optimistic outlook shared by ETF buyers, as seen within the chart under.

On this matter, crypto analyst “On-Chain School” went to social media X (previously Twitter) to emphasize the numerous demand for Bitcoin as evidenced by its speedy departure from exchanges.

In its evaluation, On-Chain School highlights that Bitcoin ETFs purchase roughly ten occasions the every day quantity of BTC mined. On the identical time, the upcoming halving occasion will additional cut back the mining provide. The analyst predicts when demand will exceed out there provide, resulting in potential upward worth stress.

Highest Month-to-month Shut Since 2021

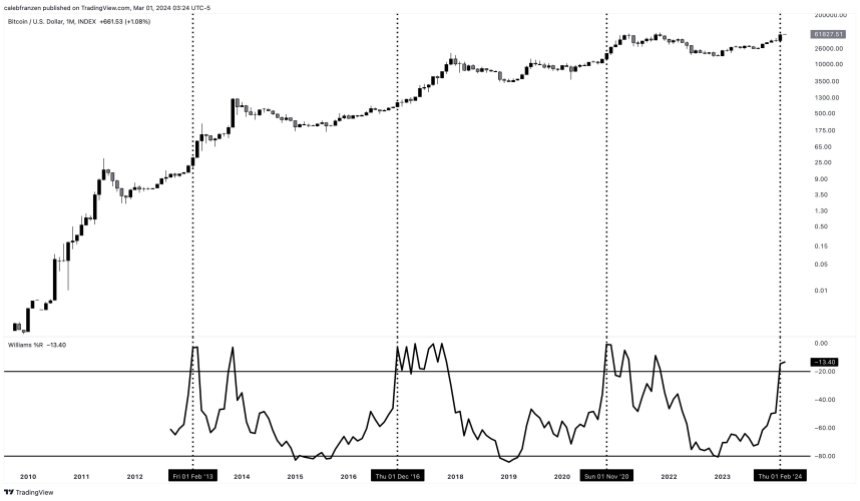

Bitcoin’s current market efficiency has caught the eye of wealth supervisor Caleb Franzen, who highlights the importance of the best month-to-month shut since October 2021.

Franzen additional emphasizes the bullish momentum by mentioning that the 36-month WilliamspercentR Oscillator has closed above the overbought degree for less than the fourth time in historical past. Historic information reveals spectacular returns following such indicators, indicating the potential for substantial beneficial properties within the coming months.

Moreover, Franzen notes the altering dynamics of the market, with elevated institutional participation and the convenience of retail onboarding by way of ETFs.

Franzen presents a compelling case for the bullish nature of overbought indicators, urging market individuals to view them as momentum indicators moderately than indicators to fade. Earlier cases of overbought indicators have resulted in vital Bitcoin worth appreciation:

- February 2013: +3,900% in 9 months

- December 2016: +1,900% in 12 months

- November 2020: +260% in 12 months

Whereas acknowledging diminishing returns in every cycle, Franzen highlights the unprecedented degree of institutional participation and the convenience of retail entry by way of ETFs.

Even when Bitcoin have been to match the +260% achieve from the November 2020 sign, it might attain a worth of $180,000, surpassing Franzen’s minimal cycle goal of $175,000.

In the end, Franzen notes that bull markets are usually characterised by a rising ETHBTC ratio and a falling BTC.D (Bitcoin dominance). Whereas these traits have but to manifest absolutely, Franzen suggests {that a} multi-quarter rally within the broader cryptocurrency market could also be on the horizon.

Featured picture from Shutterstock, chart from TradingView.com