Table of Contents

In early February, American Categorical launched new assertion credit to 6 of Delta Air Traces’ seven cobranded playing cards:

- Delta SkyMiles® Gold American Categorical Card

- Delta SkyMiles® Gold Enterprise American Categorical Card

- Delta SkyMiles® Platinum American Categorical Card

- Delta SkyMiles® Platinum Enterprise American Categorical Card

- Delta SkyMiles® Reserve American Categorical Card

- Delta SkyMiles® Reserve Enterprise American Categorical Card

These new perks with Delta Stays, on ride-hailing providers and at eating places are designed to offset elevated annual charges (see charges and charges for the Gold, Gold Enterprise, Platinum, Platinum Enterprise, Reserve and Reserve Enterprise).

Receiving assertion credit will be tough; nevertheless, primarily based on accounts from TPG staffers and information factors on different websites, I’m right here to information you on what purchases set off the assertion credit and find out how to maximize them.

Journey-hailing assertion credit score

Each the non-public and enterprise variations of the Delta Platinum and Delta Reserve supply assertion credit for ride-hailing providers. These cardmembers obtain as much as $120 in ride-hailing credit yearly (as much as $10 in month-to-month credit).

No matter which of the 4 Delta Amex playing cards you’ve, the phrases and situations state:

…used to make eligible purchases within the U.S. with the next rideshare providers: Uber, Lyft, Curb, Revel, and Alto, that are topic to alter. Nonetheless, every enrolled Card Account is barely eligible for as much as $10 in assertion credit monthly, for a complete of as much as $120 per calendar yr per Card Account.

Which means solely the 5 listed ride-hailing corporations are eligible to earn assertion credit and that the purchases must be in the USA. Uber purchases exterior the U.S. is not going to set off the assertion credit score, nor will purchases with some other ride-hailing firm, equivalent to Seize (well-liked in Southeast Asia) and FreeNow (in Europe). Reddit customers have reported that loading Uber Money doesn’t set off the assertion credit score because it doesn’t code as a journey buy.

A number of TPG staffers have had success in utilizing their ride-hailing credit score. TPG journey information reporter Tarah Chieffi used her Delta Reserve and, inside two days, obtained an e-mail confirming she had earned a $10 assertion credit score on her Lyft journey. Equally, senior search engine optimisation supervisor Hannah Streck earned her assertion credit score on a Lyft journey a day after her transaction posted. Senior director of product administration Gabe Travers additionally efficiently earned an announcement credit score on a pre-scheduled Uber journey the day after he accomplished his journey, whereas director of content material Nick Ewen had luck in getting an announcement credit score for buying Lyft Money (however discovered he needed to load a minimum of $25 to set off the credit score utilizing this methodology).

The month-to-month credit score is use it or lose it — which means it doesn’t roll over — so cardmembers ought to purpose to make use of it each month to maximise the perk.

It’s essential to notice that the brand new assertion credit on the Amex Delta cobranded playing cards solely work after you enroll within the profit. Go to your on-line account or the Amex cellular app, choose your eligible Delta card and navigate to the “Advantages” part to activate the ride-hailing credit score. Any purchases made earlier than enrolling within the profit is not going to earn you an announcement credit score.

Associated: Frequent Uber or Lyft person? These are one of the best bank cards for you

Resy assertion credit score

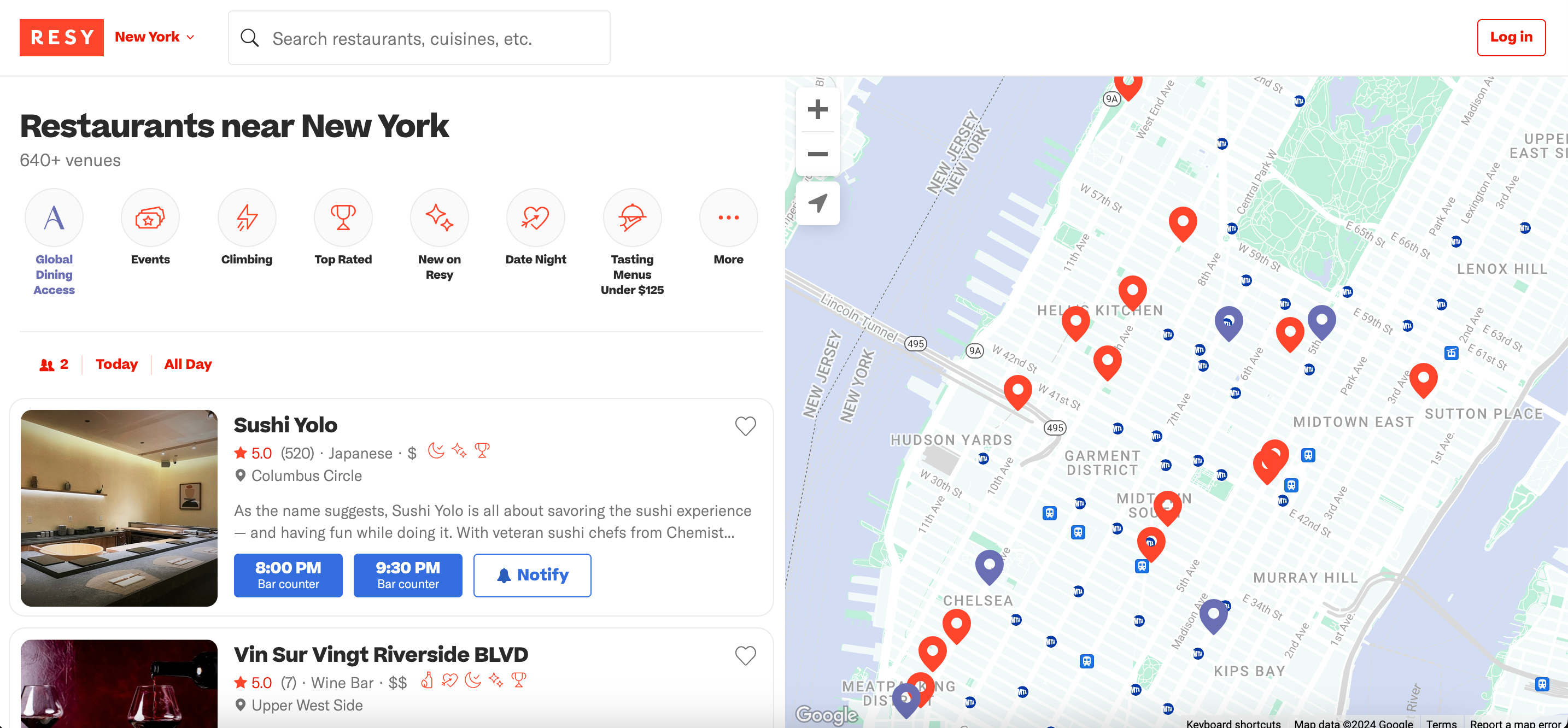

The private and enterprise variations of the Delta Platinum and Delta Reserve obtain assertion credit score on purchases made with Resy. Platinum cardmembers obtain as much as $120 Resy credit yearly (as much as $10 month-to-month); in the meantime, Delta Reserve cardmembers obtain the next allowance of as much as $240 yearly (as much as $20 month-to-month).

The phrases and situations for the non-public and enterprise variations of the Delta Platinum state:

…the entire quantity of assertion credit for eligible Resy purchases is not going to exceed $10 monthly, for a complete of $120 per calendar yr in assertion credit, per Card Account. Eligible Resy purchases embody purchases at U.S. eating places that provide reservations on Resy.com and the Rsy app, and purchases made instantly on Resy.com or within the Resy app. Eating places should be stay on Resy.com or the Resy the app at time of buy to be eligible for the assertion credit score and are topic to alter at any time. Purchases made by way of Resy Pay and purchases of Resy OS restaurant administration software program will not be eligible.

Knowledge factors discovered on-line at FlyerTalk and Reddit paint a principally constructive image of how the assertion credit are utilized. Merely put, cardmembers will earn the assertion credit score in the event that they dine at a restaurant that makes use of Resy to make reservations. Nonetheless, you don’t really have to make a reservation via Resy; you’ll obtain the assertion credit score simply by paying along with your eligible Delta Amex card (even and not using a reservation).

In line with this logic, it doesn’t matter in the event you pay for the entire invoice or part of it; so long as you utilize a private or enterprise model of the Delta Platinum or Delta Reserve, you’ll obtain the assertion credit score. That mentioned, Resy is a widely known restaurant reserving platform with greater than 9,000 restaurant companions. In the event you stay in metropolitan areas equivalent to New York, Chicago or Miami, you’ll positively have Resy-affiliated eating places in your space.

As a reminder, cardmembers should enroll earlier than using the assertion profit perk, so go to your on-line account or the Amex app to take action.

Associated: Do you’ve a Delta Amex card? Listed below are 9 issues you want to do

Delta Stays assertion credit score

Delta Stays is a brand new on-line platform powered by Expedia to ebook lodges and trip leases. The assertion credit score can vary from as much as $100 to as much as $250, relying on which cobranded Delta you carry.

The phrases and situations for the assertion credit score validity interval and eligible prices are as follows:

Eligible Delta Stays Reserving doesn’t embody curiosity prices, cancellation charges, property charges, resort charges, or different related charges, or any prices by a property to you (whether or not on your reserving, your keep or in any other case). For instance, if an eligible buy is made on December 31, however the service provider processes the transaction such that it’s recognized to us as occurring on January 1, the January assertion credit score can be utilized.

Senior director of product administration Gabe Travers used his Delta Reserve card for a Delta Stays reserving and obtained the assertion credit score 4 days later. Knowledge factors from Reddit customers paint an identical image, with customers stating it has taken anyplace from two to 6 days from the date of buy for his or her Delta Stays credit score to submit to their accounts.

To maximise the assertion credit score, keep away from last-minute pay as you go bookings on the finish of the yr as a result of if a transaction posts to your account after Dec. 31, you’ll lose out on the assertion credit score for the yr. No matter when the transaction posts, Amex states receiving the assertion credit score can take as much as 90 days.

In contrast to the ride-hailing and Resy assertion credit, cardmembers don’t have to enroll for this profit. Merely go to the Delta Stays web site and make a pay as you go reserving along with your eligible cobranded Delta card.

Associated: Delta Holidays enhances incomes charges and redemption worth for SkyMiles members

Backside line

The newly added assertion credit on a number of Delta cobranded Amex playing cards present stable worth to cardmembers. Journey-hailing and Resy assertion credit require you you enroll in the advantages earlier than utilizing them. To maximise these two credit, attempt your finest to make use of them on a month-to-month foundation. And ebook your pay as you go Delta Stays lodging earlier than the top of the yr to keep away from lacking out on the financial savings you’re entitled to.

Associated: New Delta bank card welcome affords

For charges and charges of the Delta SkyMiles Gold, click on right here.

For charges and charges of the Delta SkyMiles Gold Enterprise, click on right here.

For charges and charges of the Delta SkyMiles Platinum, click on right here.

For charges and charges of the Delta SkyMiles Platinum Enterprise, click on right here.

For charges and charges of the Delta SkyMiles Reserve, click on right here.

For charges and charges of the Delta SkyMiles Reserve Enterprise click on right here.