Inflationary pressures in the US are poised to hit crypto-friendly quick meals chains, probably resulting in a downturn of their fortunes. Latest information from the Bureau of Labor Statistics signifies a surge in inflation, leading to challenges associated to uncooked supplies and the labor market. As the price of important elements rises, quick meals institutions could expertise decrease income, a lower in buyer footfall, and better labor prices.

Eating Dilemma: Value Of Consuming Out Soars

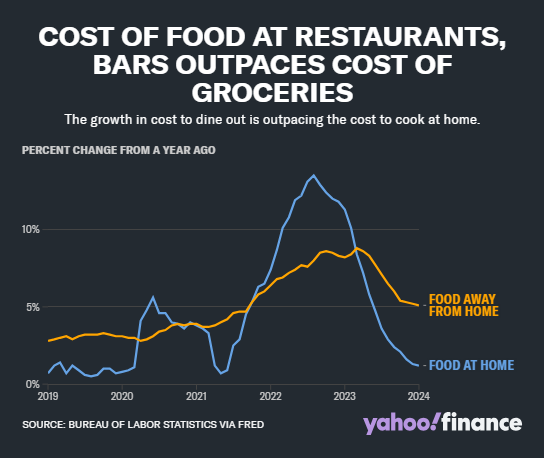

In accordance with a report by Yahoo Finance, People have gotten more and more hesitant to simply accept invites for elegant eating experiences outdoors their properties. In January alone, the price of consuming out rose by 5.1% in comparison with the identical month final 12 months and by 0.5% from the earlier month. Conversely, grocery costs witnessed a extra modest improve of 1.2% over the earlier 12 months and 0.4% over December, stabilizing thereafter.

Prior to now, in response to Citi analyst Jon Tower, a sample has emerged the place, if commodity inflation outpaces labor inflation, grocery costs are inclined to rise sooner than these at eating places. Conversely, when labor inflation exceeds commodity inflation, restaurant costs are inclined to surpass these of groceries.

“Traditionally, when commodity inflation runs forward of labor inflation, grocery pricing pushes forward of eating places,” Tower wrote in a shopper be aware.

This pattern suggests that customers could choose to cook dinner at residence extra incessantly as the price of eating out continues to rise. Moreover, the upper value of residing interprets into elevated costs for uncooked supplies, posing profitability challenges for quick meals chains.

A number of crypto-friendly quick meals chains are already going through the influence of hovering inflation. KFC, famend for promoting the “Bitcoin Bucket,” encountered difficulties as poultry costs reached an all-time excessive final 12 months.

Equally, Starbucks, which permits clients to pay with Bitcoin, confronted a greater than 40% improve in commodity costs for Arabica espresso for the reason that onset of the pandemic. Subway, one of many pioneers in accepting Bitcoin as fee, has grappled with the rising prices of important greens, bread, and different uncooked supplies.

Along with the escalating prices of uncooked supplies, quick meals chains working a minimum of 60 websites throughout America will quickly face the need of accelerating the minimal wage for his or her restaurant staff to $20 per hour. This impending change, set to take impact in April, is prone to exacerbate challenges associated to profitability and money movement.

Crypto Funds Dwindle Amid Inflation Considerations

The influence of rising inflation extends past the quick meals trade to the realm of crypto transactions. As eating places wrestle to keep up their foothold out there, many shoppers could choose to keep away from utilizing cryptocurrencies as fee.

Conducting crypto transactions on varied platforms incurs charges, and with buying energy already below pressure, clients could search to reduce further bills and as an alternative desire money or card funds.

Featured picture from , chart from TradingView