Tuur Demeester, a Bitcoin OG and researcher for Adamant Analysis shared his bullish outlook for Bitcoin by way of X (previously Twitter), anticipating its worth might escalate to between $200,000 and $600,000 by 2026. Demeester’s prediction is based on the inflow of trillions of {dollars} by means of world bailouts and stimulus measures, which he believes will considerably propel Bitcoin’s valuation.

He remarked by way of X (previously Twitter), “In ’21 bitcoin topped at $69k. I’m concentrating on $200-$600k by 2026. Fueled by $ trillions in world bailouts/stimulus,” indicating a powerful conviction within the cryptocurrency’s future amidst expansive financial insurance policies.

In ’21 bitcoin topped at $69k. I am concentrating on $200-$600k by 2026. Fueled by $ trillions in world bailouts/stimulus. https://t.co/ULslIMgzee

— Tuur Demeester (@TuurDemeester) February 12, 2024

In response to the query of whether or not the Bitcoin worth will peak in 2025 or 2026, Demeester added: “It’s arduous to say. We would get a bull cycle in two elements, like in 2013 – that would draw it out longer.”

Demeester’s monitor document lends weight to his forecasts. Notably, in September 2019, he precisely anticipated the earlier bull run’s momentum, suggesting Bitcoin might attain $50,000 to $100,000. The fact surpassed expectations as Bitcoin peaked above $69,000 in November 2021, validating his prediction vary’s higher finish.

Why The Bitcoin Rally Is Far From Over

Including depth to his newest prediction, Demeester pointed to Google traits knowledge, which frequently serves as a barometer for retail investor curiosity in Bitcoin. Regardless of Bitcoin hitting $50,000 yesterday, Yassine Elmandjra, a researcher at Ark Make investments, highlighted that Google search volumes relative to Bitcoin’s worth are at all-time lows, suggesting a scarcity of widespread retail frenzy at this stage.

Bitcoin hit $50k.

In the meantime, Google search volumes relative to cost are in any respect time lows.

This can be a new period. pic.twitter.com/8DnsadIclt

— Yassine Elmandjra (@yassineARK) February 12, 2024

This commentary led Demeester to recommend, “I anticipate for retail to begin waking up quickly. Bear in mind, there is no such thing as a fever like Bitcoin fever,” indicating his anticipation of a surge in retail engagement as soon as Bitcoin’s worth momentum gathers tempo.

Demeester additionally shared sage recommendation for traders, cautioning towards the perils of debt and overexposure given Bitcoin’s infamous volatility. He emphasised the psychological resilience required to ‘HODL’ by means of market turbulence, stating, “The HODL perspective requires psychological & emotional work. The unprepared investor can not sit tight, solely the one who has labored to think about the market relentlessly punching him within the face.”

Addressing inquiries in regards to the future trajectory of Bitcoin, Demeester expressed uncertainty concerning the continuation of the four-year cycle sample, suggesting that market dynamics are too complicated for such predictable cycles to persist indefinitely. “I don’t know if the four-year cycle will maintain. That sounds too good to be true tbh. All patterns appear to ultimately break,” he commented, highlighting the unpredictable nature of markets.

On the subject of the anticipated financial bailouts, Demeester clarified his stance, pointing to the unsustainable fiscal practices of banks and governments as a catalyst for financial growth.

“Of banks and governments. For instance, the US authorities right now is already spending extra on curiosity funds than on their army. Solely strategy to preserve going is to print an ocean of cash,” he defined, offering a grim outlook on the monetary stability of key establishments and the potential for BTC to profit from these situations.

Cash Printing = Numbers Go Up

To grasp Demeester’s claims, it’s important to know the broader financial dynamics at play. Financial stimulus packages and bailouts, notably in response to crises, inject liquidity into monetary markets, probably devaluing fiat currencies by means of inflation.

Onerous property like Bitcoin, with their capped provide, stand in distinction to potential inflationary pressures, providing a hedge towards forex devaluation. This dynamic, coupled with rising institutional adoption by spot ETFs and the rising recognition of Bitcoin as a ‘digital gold,’ might ship BTC’s worth to unprecedented heights, aligning with Demeester’s projections.

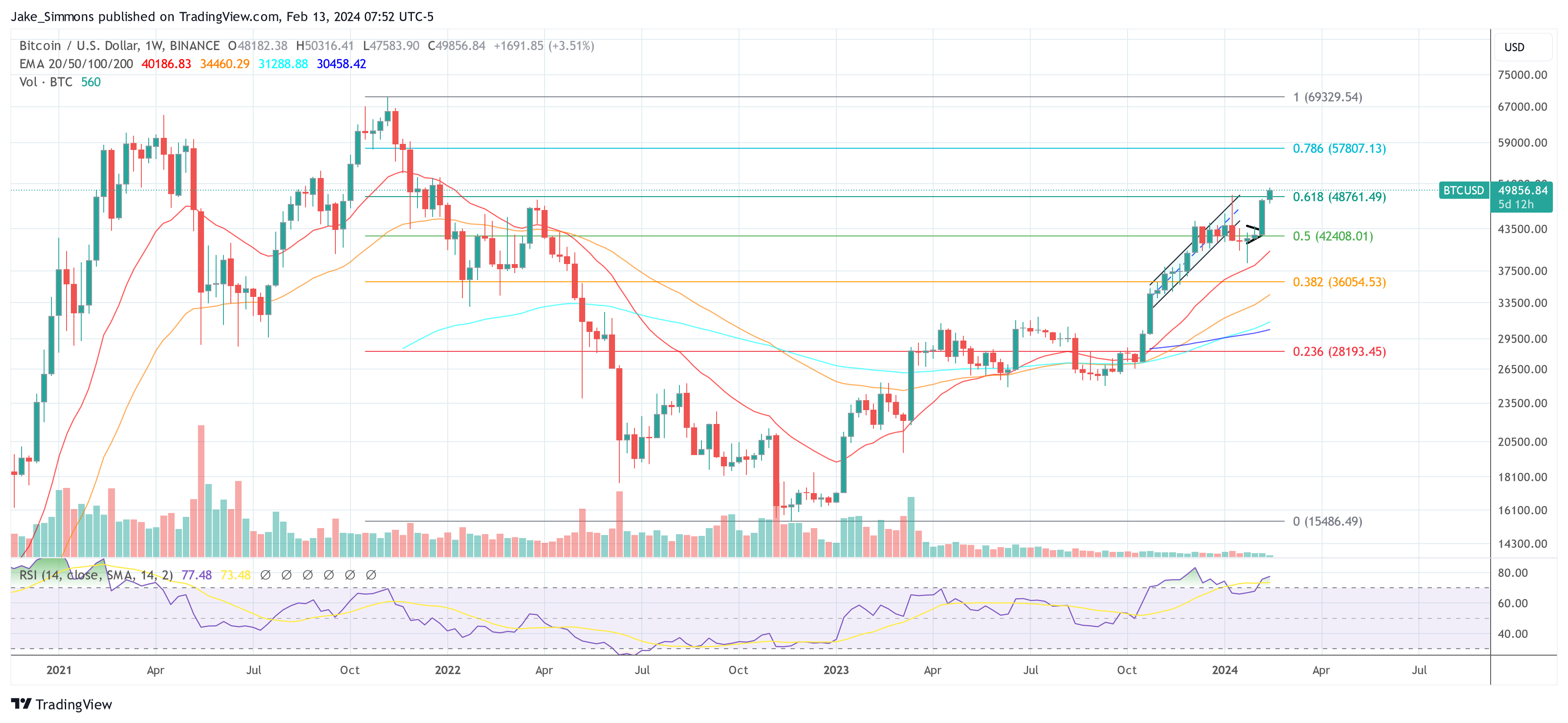

At press time, BTC traded at $49,856.