An analyst has defined when the following Bitcoin bull run peak may seem, if the identical sample as in earlier cycles repeats this time as nicely.

This Is What Earlier Bitcoin Cycles Recommend Relating to Bull Run Prime

In a brand new submit on X, analyst Ali has mentioned about how the final two Bitcoin bull runs line up in opposition to one another and what it may imply for the present cycle of the cryptocurrency.

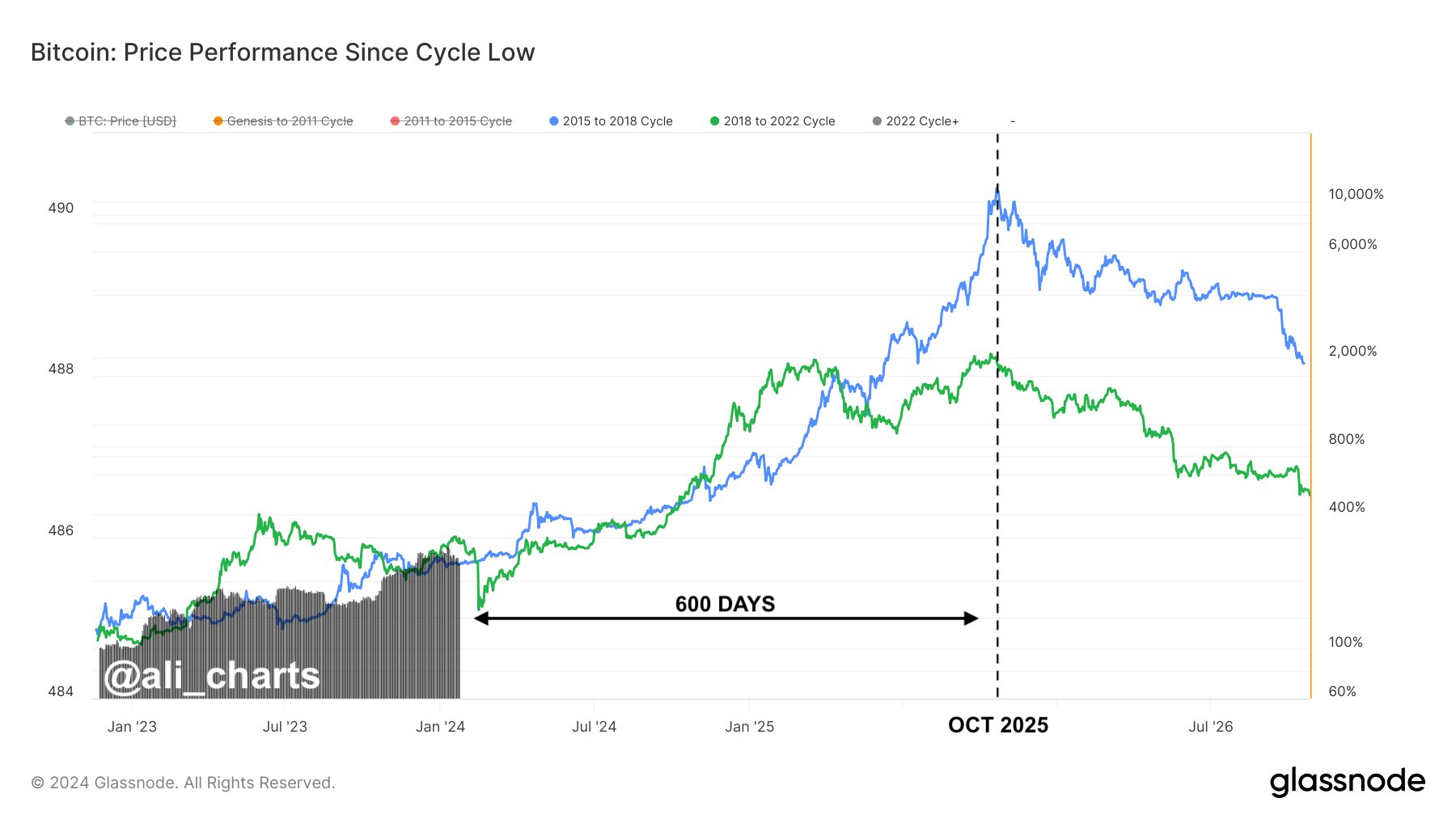

To make the comparability, the analyst has cited a chart that exhibits the value development in every of the cycles with the cyclical bottoms being the frequent start-point for all of them.

From the graph, it’s seen that the peaks of the final two Bitcoin bull runs took form at roughly the identical period of time for the reason that bottoms of the respective cycles.

For the present cycle, the low that adopted the FTX collapse in 2022 has been chosen as the underside. If the present cycle is lined up in opposition to these different two ranging from this backside, then it might nonetheless have roughly 600 days earlier than it reaches the identical level as when the final couple of bull runs hit their tops.

“If Bitcoin mirrors previous bull runs (2015-2018 & 2018-2022) from their respective market bottoms, projections counsel the following market peak may land round October 2025,” says Ali. “This means BTC nonetheless has 600 days of bullish momentum forward!”

BTC Has Been At Threat Of Slipping Under A Historic Line Lately

Whereas BTC could have a bullish outlook for the long run, its short-term worth development has been painful for buyers, because the cryptocurrency has seen a notable drawdown for the reason that spot ETFs discovered approval from the US SEC.

The cryptocurrency had earlier even slipped down in the direction of the $38,500 mark earlier than making some restoration again across the $40,000 stage that it’s nonetheless buying and selling round.

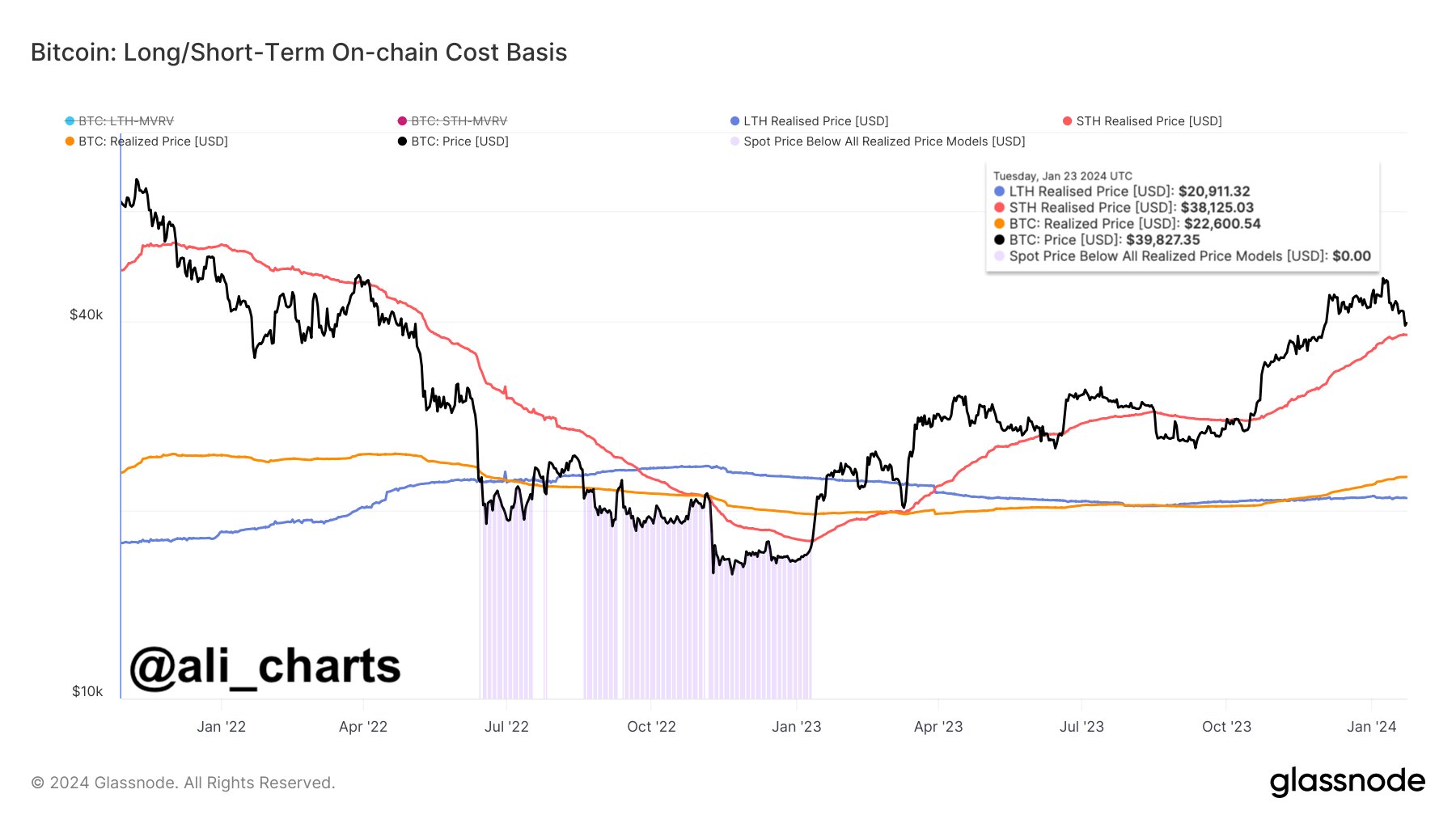

On this newest plunge, Bitcoin got here dangerously near retesting the “short-term holder realized worth,” a stage that has been vital for the asset all through historical past.

The “realized worth” is a metric that retains monitor of the value at which the common investor within the Bitcoin market acquired their cash. The spot worth being above this worth naturally implies the common holder within the sector is carrying earnings, whereas it being underneath the road implies the dominance of losses.

As Ali has identified in one other X submit, the “short-term holder” group will discover themselves underwater if the cryptocurrency’s worth slips underneath the $38,130 stage.

Brief-term holders (STHs) consult with the Bitcoin buyers who bought their cash inside the final 155 days. In the meanwhile, their realized worth stands on the $38,125 stage. Traditionally, a sustained break under this line has usually meant an prolonged keep for the coin under it.

Thus far, BTC has averted a retest of this line, but when the present correction continues, it would even slip underneath it. “This potential BTC dip may set off a brand new wave of panic promoting as these holders will search to reduce losses,” explains the analyst.