Since mid-January Bitcoin (BTC) has been going through mounting promoting stress from varied market gamers. This contains asset supervisor Grayscale, bankrupt crypto alternate FTX, and now, the US authorities, which is ready to public sale off a considerable quantity of Bitcoin seized from the notorious darkish internet market Silk Street.

Sale Of Confiscated Silk Street Bitcoin

The US authorities has filed a discover to promote roughly $130 million price of Bitcoin confiscated from Silk Street. The submitting states that the US intends to get rid of the forfeited property as directed by the US Legal professional Common.

People or entities, aside from the defendants within the case, claiming an curiosity within the forfeited property should file an ancillary petition inside 60 days of the preliminary publication of the discover.

As soon as all ancillary petitions have been addressed or the submitting interval has expired, the US will get hold of clear title to the property, enabling them to warrant good title to subsequent purchasers or transferees.

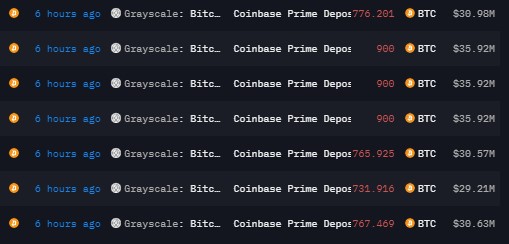

The continued promoting stress on BTC has resulted in a pointy 20% correction over the previous 10 days. This development is anticipated to proceed and additional amplify the promoting stress. Including to the scenario, asset supervisor Grayscale, whereas slowing down its promoting actions, continues to switch a major quantity of Bitcoin to Coinbase.

Based on knowledge from Arkham Intelligence, Grayscale not too long ago despatched an extra 10,000 BTC price $400 million to Coinbase.

For the reason that approval of the Bitcoin spot exchange-traded fund (ETF), Grayscale has deposited a complete of 103,134 BTC ($4.23 billion) to Coinbase Prime. Presently, Grayscale holds 510,682 BTC ($20.43 billion).

Best Shopping for Alternatives?

Adam Cochran, a distinguished market skilled, has offered insights into the current worth motion and the expectations of Bitcoin consumers. Cochran highlights that mixture open curiosity (OI) for BTC has decreased by 17% from current highs however stays round 20% greater than the averages noticed throughout extra secure market ranges.

Cochran notes that the market has seen makes an attempt to catch falling costs, suggesting a mixture of “refined” and leveraged consumers.

Cochran additional observes that retail buyers are pushed by narratives surrounding the ETF and halving occasions, main them to purchase dips on leverage. Nonetheless, many buyers stay unconvinced concerning the market’s route and are ready for a transparent entry level, in response to Cochran’s evaluation.

Notably, Cochran highlights that the present funding charges don’t point out a bearish sentiment, even in choices buying and selling, suggesting an expectation of a backside formation shortly.

The market’s dynamics are influenced by feelings and possibilities, and Cochran believes that too many members are overexposing themselves emotionally by attempting to catch the underside of the market on every dip.

This conduct has elevated the chance that the current worth motion could not mark the underside but. Cochran suggests {that a} sentiment reset, a decline within the 3-month annualized foundation by round 25%, and an extra lower in open curiosity would supply a more healthy surroundings for main performs out there.

In the end, Cochran emphasizes the necessity for a reset in expectations, highlighting {that a} interval of doom and despair is important for market members to reassess their positions.

Cochran factors out {that a} vary between $35,000 and $37,000 BTC might be an appropriate stage for bigger spot buys in the long run. Nonetheless, Cochran additionally notes {that a} potential drop to the $28,000 to $32,000 vary may present supreme situations for assured, leveraged deployment.

Presently, BTC is buying and selling at $39,800, up a slight 0.6% prior to now 24 hours, however down over 14% prior to now fourteen days.

Featured picture from Shutterstock, chart from TradingView.com