Table of Contents

Just lately, Bitcoin skilled a major drop, crashing 15% from its 2024 highs round $49,000. This decline adopted carefully on the heels of the approval of 11 spot Bitcoin Change-Traded Funds (ETFs), a transfer that was initially met with optimism within the crypto neighborhood. The sudden downturn has left buyers and merchants analyzing the charts for clues about Bitcoin’s subsequent transfer.

Is The Bullish Bitcoin Development Over?

Within the wake of this decline, technical evaluation provides a beacon of perception. Notably, the correction was marked by a bearish engulfing candle on the every day chart, signaling a possible reversal in Bitcoin’s upward development.

Accompanying this was a nasty wick – an extended higher shadow on the candlestick chart, indicating a major sell-off after costs peaked.

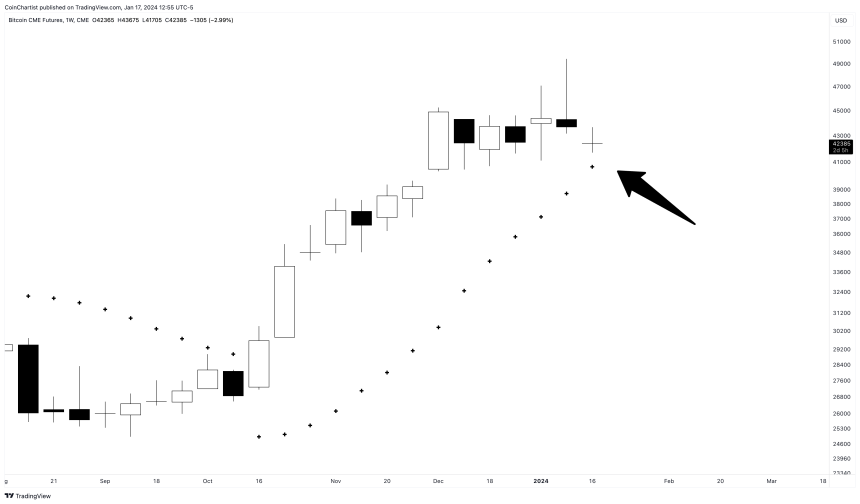

Additional complicating the panorama was the opening of the CME BTC Futures with a sizeable hole down. Such gaps are sometimes seen as potential resistance ranges, reinforcing the bearish sentiment.

Cease And Reverse: A Ray Of Hope

Nonetheless, amidst these seemingly destructive indicators, a ray of hope shines via from a “parabolic” technical indicator – the Parabolic SAR (Cease and Reverse).

Regardless of the tumultuous market circumstances, the weekly BTCUSD Parabolic SAR indicator stays untagged, suggesting that the long-term uptrend continues to be intact.

This indicator, identified for its effectiveness in figuring out potential reversals out there’s path, paints a distinct image from the rapid bearish indicators and sentiment.

What Is The Parabolic SAR?

To completely grasp the importance of the Parabolic SAR on this context, it’s important to grasp what it’s and the way it capabilities. The Parabolic SAR is a well-liked technical evaluation instrument used primarily to find out the path of an asset’s momentum and to supply entry and exit factors.

The ‘SAR’ in Parabolic SAR stands for ‘Cease and Reverse.’ This indicator is represented on charts as a sequence of dots positioned both above or beneath the worth bars. A dot positioned beneath the worth is seen as a bullish sign, whereas a dot above is bearish.

The distinctive facet of the Parabolic SAR is its skill to behave as a trailing cease loss. As the worth of an asset strikes, the Parabolic SAR adjusts, shifting nearer to the worth line. This adjustment offers a dynamic technique for merchants to handle their positions, securing income whereas limiting potential losses.

Within the context of Bitcoin’s present scenario, the Parabolic SAR’s place – nonetheless beneath the worth bars on the weekly chart – means that the long-term bullish development will not be but disrupted.